Online economics and consumer attitudes

Editor’s note: These are excerpts from material contributed by the Pew Internet Project to the Pew Research Center’s Project for Excellence in Journalism “State of the News Media 2010” report – available in full at http://www.stateofthemedia.org/2010/. The material related to consumer attitudes about online news business models was part of a joint survey between Pew Internet and PEJ.

Overview

The state of online news heading into 2010 may best be described as a moving target.

Digital delivery is now well established as a part of most Americans daily news consumption. Six in ten Americans get some news online in a typical day—and most of these also get news from other media platforms as well. Yet it remains unclear how best to count the audience online….

It remains as unclear in 2010 as ever how to monetize the growing audience. The year past was a time of experimentation for all kinds of entities, — but many have yet to materialize and others have little yet to show in terms of real dollars. The most established revenue source, online advertising, saw declines for the first time since 2002. The declines were partly due to recession, but it is not clear to what extent the declines may also be structural and permanent. And the most talked about new revenue stream – getting users to pay for content – will depend, economists argue, on news organizations offering content that is unique, and this may require specialization and investment by news organizations.

The year past proved important for social media establishing themselves as a part of the media ecosystem. The power here had less to do with reporting than serving as a place for people to quickly come together around an issue that they feel passionately about to share concerns, pass along information, offer financial contributions and in several cases bring about change.

Citizen news sites continued to evolve as well, in part because, still financed with start up funds or contributions from nonprofits, they were less affected in some cases by the recession’s downturn in advertising. New research released as part of this report, however, provides more evidence that even the most established citizen sites are not in a position to take on the job of traditional news outlets. Instead, what has begun to emerge is more of a coming together of the two, particularly at the local level….

Where online economics stands

The prospect of an economic model for journalism online made only limited progress in 2009, even as the industry’s eagerness to find new Internet-based revenue sources intensified.

Signs that advertising, at least in any familiar form, would ever grow to levels sufficient to finance journalism online seemed further in doubt.

News organizations talked about the need for pay walls to charge for content, but there was little evidence that anyone had found a successful model.

And, public sentiment, according to survey data from the Pew Internet Project and PEJ released for the first time in a separate section of this report, seems strongly resistant to any such model.

Certainly the ad revenue numbers for 2009 were not encouraging. Overall, U.S. online advertising during the year had its first decline since 2002, according to the online research firm eMarketer, which began tracking in 1996. The firm, whose updated August projections were the most recent, called for revenues to fall 4.6% in 2009 to $22.4 billion, down from $23.4 billion in 2008. And the numbers for the categories that finance news were worse than that.1

Actual revenues for the first six months of the year suggest these projections are on track. From January through July overall online ad revenues declined 5.3% to $10.9 billion down from $11.5 billion in the same period of 2008, according to Price Waterhouse Cooper.2

eMarketer sees a turnaround for online advertising in 2010, with revenues beginning to inch back up again to 23.6, a level slightly higher than 2008.3 Other market research projections, though produced earlier, were more optimistic.4

Future Economic Models

As evidence mounted that advertising alone will not be enough to support the news industry online, we heard in 2009 louder rumblings of alternative revenue streams to sustain news operations.

There was much talk this year of introducing some form of user payment, of demanding compensation from aggregators and of finding new ways to appeal to advertisers.

Much of this remained theoretical. But some experiments did begin – and bear watching. Among the kinds of new revenue streams discussed:

- Payments from users:

News organizations have mostly discussed two ways of securing direct payment from consumers: full subscriptions and pay-per article fees, often referred to as micro-payments or aggregated microaccounting.

Full subscriptions

Even though most early attempts at full subscriptions have failed to lure users away from the vast array of free content available on the Internet, many news organizations in 2009 returned to the idea. One of the most vocal proponents was Rupert Murdoch, whose News Corp. has had some of the greatest success in pay-wall subscriptions. New Corp.’s Wall Street Journal charges $79 for yearly access to its websites and was the only newspaper to turn a profit in 2009. In August 2009, Murdoch announced that News Corp. would be extending this model to all of its websites but it has yet to take any action on the matter.

Most other success along these lines has come from specialty newsletters or online databases like LawTrack from Congressional Quarterly and ClimateWire, published by Environmental and Energy Publishing. Consumer Reports is often mentioned as a success poster child. All of these provide deep reporting into a specific topic area that appeals to a narrow, industry-focused clientele that can often include the subscription price in work budgets. The subscription prices range widely, depending on the market, but those with a large industry following can be in the thousands of dollars a year.

Mircropayments

Here, in theory, users pay for content piece by piece, so the price varies according to how much one consumes from a site. Experiments here have come from individual news organizations as well as aggregate sites that pool together content from many different news organizations.

The New York Times announced on January 20, 2010 that it would be adopting this method sometime in 2011. The paper’s publisher, Arthur O. Sulzberger Jr., said, “Our audiences are very loyal and we believe that our readers will pay for our award-winning digital content and services,” but he offered few details, other than that consumers could access a certain number of articles for free before hitting the pay wall.5

- Microaccounting: Aggregator-style experiments come from Kachingle, Journalism Online and CircLabs. Each relies generally on building a network of collaborating services.

Kachingle’s model is based on a monthly fee of $5 that users pay. Then Kachingle will take the money from the fee and divvy it up among the sites that the user chosen to access. To receive a pro-rate share of the $5, a site must join the Kachingle network and display its icon. Kachingle went live in late 2009.

Journalism Online (JO) allows users to sign up for annual, monthly, day passes, or per-article payment from participating content providers. JO announced in February, 2009, that it would begin testing with two newspaper sites owned by MediaNews Group Inc.

CircLabs, at the Reynolds Journalism Institute at the University of Missouri, partners with news sites to invite users to sign up for a personalized news feed delivered via a downloadable browser application it calls the Circulate Bar. CircLabs will then partner with transaction third parties to build a network of content providers serving premium links into the bar. CircLabs starts a private beta in late March.

In all three cases the consumer would not “pay per click” but would be charged periodically and the payments divided among a variety of providers through a microaccounting process.

Some of the immediate criticism of this approach is that it puts the greatest fee on the news organization’s most loyal audience, pressuring people to consume less because the more a user consumes, the more she pays. In addition, some involved in these networks finds a big challenge to be identifying unique content that consumers will value sufficiently to pay for on any basis.

One hybrid option is a plan often referred to as “Freemium” plans that offer some content for free and “premium” material for a fee.

In late 2009, the consulting firm Accenture surveyed executives from 102 media firms, including those outside the news business, and asked about the business models that they thought would be embraced throughout media firms in the next three years. Many said that they expected that hybrid models combining several revenue streams and combinations of free and pay services would emerge in the coming years.6 Specifically:

- 39% of the executives said the predominant model would be advertising-funded

- 21% said it would be a hybrid model of multiple revenue streams

- 18% said it would be “freemium” systems that would offer some free content to users and hope to encourage people to pay for “premium” content that went deeper and more analytically into subjects, perhaps with customized material for particular users.

- 14% said it would be subscription-based offerings

- 8% said the predominant model would be “pay for play” or “on demand” services that were bought a la carte.

Headed into 2010 there was no clear consensus on what the economic model would look like in the future. What is fairly clear is that no one model will replace advertising as the major revenue source for news.

- Advertising Innovations: Beyond payments from users, some experiments in new online advertising are already underway.

Targeted advertising

One of the biggest drawbacks with display ads in the eyes of advertisers is that they are not as targeted at consumers as search ads are. In search, if you type “vacation” into Google, along with the search results will be ads associated with vacation, like travel agencies, cruises and the like, also associated with your geographic region or the places where you have expressed an interest in visiting. Users then may actually find the ad helpful and advertisers like that at least some of the people seeing there ads are already primed for whatever they are selling.

In an attempt to bring more targeting to display ads, California businessman and former newspaper executive Alan Mutter is planning something he calls ViewPass.

Although this service has not been launched, the approach is worth noting: Rather than have users pay directly for content (subscriptions, micropayments, etc.), they would submit various demographic data to the system before viewing the content. The expectation then is that ads can be sold at a much higher rate because they can be targeted to users more specifically.

This is essentially the model used by Facebook, which is thought to have turned a profit in 2009 and was valued as a company at $6.5 billion.7 Facebook can go to advertisers with an enormous amount of data about its users — their age, gender, where they live, their relationship status, who their friends are, what groups they have joined, the kinds of purchases they post about or discuss with their friends, and lots of other behavioral facts — that can be mined to sell ads at a much higher rate.

There is tremendous ferment among privacy and consumer watchdogs about how aggressively companies, including news organizations, should be able to exploit the troves of data they gather about users. Facebook, among others, has experienced backlashes from users at times when they felt the firm was insinuating commercial interests too deeply into their personal online activities.

- Other Online Revenue Experiments

Combination models. Some organizations are developing experiments around combinations of the different revenue ideas. One such site is Information Valet, started by Bill Densmore during a fellowship at the Missouri School of Journalism’s Donald W. Reynolds Journalism Institute. Its a combination of microaccounting and interest-based advertising. The Information Valet ideas are being tested in a commercial venture, CircLabs Inc., which is part owned by the university.

The “Circulate Bar” would allow a user to optionally provide a demographic profile as data on their information interests. Circulate will then match to free and premium content and deliver reading and viewing recommendations via an always-on web toolbar. Newspapers, radio and other affiliates would offer the service to their users, and presumably make money by added traffic to their services, higher prices for advertising targeted to unique users and, in some cases, network sale of premium content. CircLabs says it will begin private beta trials in the end of March.8

Closing off aggregators- Another area of heated public discussion in 2009 involved news organizations closing off their content to aggregators like Google, or at least trying to get aggregators to pay them some kind of fee for carrying references to their articles.

Again, one of the most vocal proponents was News Corp.’s Rupert Murdoch. In April 2009 he posed the question, “Should we be allowing Google to steal our copyrights?” And in the fall he began talks with Microsoft to have News Corp. content exclusively on Bing, Microsoft’s search engine. As with the calls for subscription models, though, there has been little evidence of actual implementation. The threat that Murdoch made of pulling all of News Corp.’s content from Google has not been carried out. A compromise position, for Wall Street Journal content, has been that users can get to one Journal article for free through Google referral, and after that the pay-wall on WSJ.com would force users to pay for any additional content.

Another organization that took steps toward stopping aggregators and others from carrying their content was the Associated Press. In the summer of 2009 it launched a new system that would attempt to track its content across the Internet as it is reposted, copied, etc. Other third-party companies such as Attributor provide services that content producers can sign up for that will attempt to do the same thing, track their content across the Internet so producers can take down content if it appears in an unauthorized place. As of early 2010, though, there were no data to indicate any early level of impact or success.

In 2009, Google responded saying that news outlets can always opt out of the Google search engine. “Publishers put their content on the Web because they want it to be found,” said an unnamed Google spokesperson. “Few choose not to include their material in Google News and Web search. But if they tell us not to include it, we don’t . . . all they need to do is tell us.”

In the fall Google, offered an olive branch of sorts. It announced that it was developing a platform to allow newspapers to charge for online content, , an enhancement of the GooglePay service, in which all users must register with and pay Google. It hasn’t provided details.

Fees through the Internet service provider

Another discussed revenue stream has been the kind of subscriber access-fee that exists for cable. Cable news networks receive about half of their revenues from fees per subscriber charged to the cable service providers. These providers then pass that fee along to the consumer on their monthly cable bills. A similar model could potentially be implemented on the Internet, where fees are built into the internet access charge that users already pay. The idea remains hypothetical at this point, though, and there would be large hurdles to implementing it. One hurdle is that content providers would have to band together to lobby the broadband internet providers (Comcast, Verizon, etc.) to get a cut of the revenue the ISP’s get from broadband fees. Another is a myriad of legal issues that would need to be addressed involving the control of information. In 2008, Clickshare Service Corp. received a patent9 on a system for managing information transactions on the web and the company, which has been serving newspaper and other clients for more than a decade, believes it can implement a service in which consumers have an account at one service (such as a news, cable or Internet service provider site, and can be periodically billed for access to information from a plethora of other affiliated content sites.

Consumer Attitudes to Economic Models

The biggest question facing online journalism today is how to pay for it. With revenue declining both online and in legacy platforms news organizations say they are intensifying the search for new models. What kind of new advertising options are out there? How will users respond? And would consumers in the marketplace accept pay walls?

To learn more, PEJ and the Pew Research Center’s Internet & American Life Project collaborated on a national phone survey in January 2010 to explore consumers’ willingness to pay for news online and their attitudes and behavior in response to online advertising.

Over all, the evidence suggests the outlook is difficult both for paywalls and for online display advertising. While most people have not been asked to pay for content, even among the most avid news consumers online, only about one in five at this point say they would be willing to pay, and this does not include less voracious news consumers. At the same time, the vast majority of those online, 8 out of 10, say they basically ignore online ads.

In short, a good deal must change, the data suggests, before the digital age will begin to sustain itself.

- Pay Walls

About 71% of internet users, or 53% of all American adults, get news online today, a number that has held relatively steady in recent years.

Most of these online news consumers graze across multiple sites without having a primary one that they rely on. Only 35% of online news consumers have a favorite site.

To put it another way, 65% of online news consumers do not have a site that is so important to them that it stands out in their minds above all other sites they visit.

The users who do have a favorite site are pretty faithful. Some 65% of them check in with that favorite site at least once a day.

Yet even among these most loyal news consumers, only a minority (19%) said they would be willing to pay for news online, including those who already do so and those who would be willing to if asked.

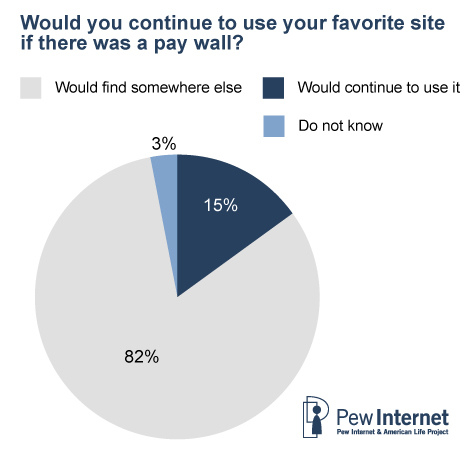

Instead, a large majority – 82% – of those with a favorite site said they would find somewhere else to get the news.

Because so few online news consumers even have a favorite site this translates to only 7% of all people who get news online having a favorite online news source that they say they would pay for.

This is a sign of just how much initial difficulty the movement toward pay walls could have.10

In sum, there appears to be only a very small cohort of voracious news consumers who have to have their news from a particular site, even if they have to pay for it. The vast majority of online news consumers, though, seem willing to browse for news from many sites, do not have a favorite online news source, and even if they do, are not willing to pay for that site’s content.

This is not to say that resistance might breakdown over time.

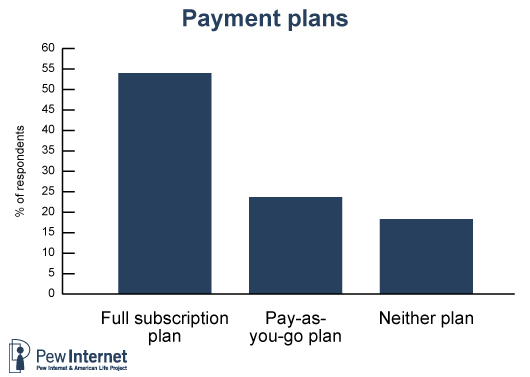

There is evidence that some kind of flat fee – a networked microaccounting system rather than a pay-per-click system — might have better success in marketplace. We asked people if they had to pay for content from their favorite site, would they prefer a subscription that would allow them to access all the content from the site or a pay-as-you-go plan where they would pay only for the articles and features they wanted to see. A substantial majority of those with a favorite site (54%) opted for the subscription model while less than half as many (24%) picked the a la carte option.11

One technical and business challenge here is this: If people want to pay by subscription, but information is increasingly disaggregated across the web – then how could they do so without having to have multiple, confusing, subscription relationships?

All these findings speak to the natural disadvantage of news content: Most news is covered by more than one organization and people do not place enough value on the difference between the various reports. In other words, if a user had to pay for a New York Times article on Haiti, evidence suggests that he or she would just look for another source that could provide the basic information. The nuances of depth or breadth in the pay story may not be valued enough to induce payment over a free alternative.

Thus, if the news industry is going to make headway with pay-walls, they are going to have to break through what for now appears to be continuing reluctance, even among its most avid consumers.12

Some additional data suggest that people may not ever get to any full news article at all. Instead, according to data from Outsell, fully 44% of visitors to Google News just scan headlines and never click on the articles themselves.13

Consumer Attitudes Toward Advertisements

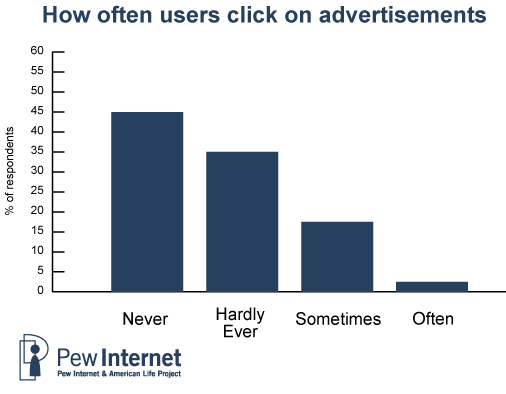

Attitudes toward advertising online are also complicated. Fully 81% of online news users say they do not mind online advertising because it allows the content to be free. But 77% say they also ignore the ads (42% online news consumers say they “never” click on one of those ads and 35% say they do so “hardly ever”).

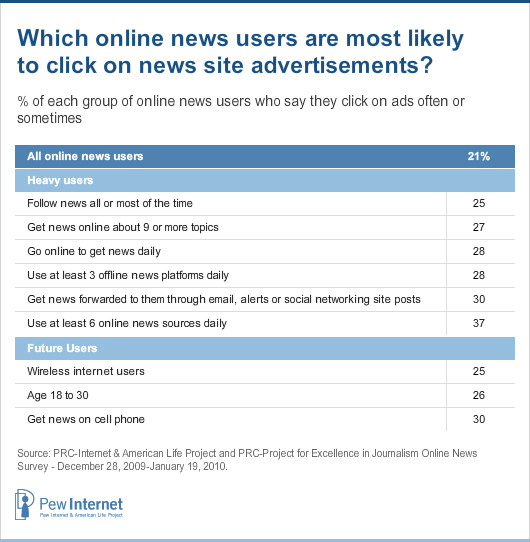

The survey data do reveal, however, that the heaviest online news consumers, as well as the most connected younger adults, are more likely to click on ads, but only marginally so. While only 21% of all online news users say they click on online ads at least sometimes, that number goes up to 28% of those who go online daily and 37% who visit at least six sites daily. And for those under 30, about 26% sometimes click on online ads as do 30% of those who get news on their cellphones. Still, even among these groups, ad consumption is low.

Overall, the data reveal the tenuous position of news producers. Unless consumer attitudes shift with a changing reality, news operations are looking at conventional advertising that will not work online or pay wall strategies that may drive down traffic.

For online news to become a profitable enterprise, either consumer attitudes need to change or the industry must do more. That more could be developing new better-targeted products that people are willing to pay for; new forms of advertising that work better, including local search; or new forms of revenue other than display advertising, including perhaps online retailing.

Elsewhere in this report, we discussed the findings of a joint survey by PEJ and the Pew Research Center’s Internet & American Life Project about the news audience and how its consumption behaviors are changing in the digital era. There are clear implications from these combined findings for those who are trying to figure out how to pay for news operations.

The fact that almost two-thirds of online news consumers do not have a favorite website strikes us as important. That is not good news for those already worried about branding issues and it makes it even tougher for those whose brands are not particularly well embedded in consumers’ minds. The fact that people now range across various news platforms (radio, TV, print, online) to get their news on a typical day makes it tougher than it used to be to establish a brand on any platform and that problem is compounded on the internet. Moreover, the fact that aggregator sites are among the most popular online news destinations is a difficult reality for news organizations that makes their product more of a commodity and less of a part of a “package” of stories that is put together by a team of editors with a special “branded” character.

There is some evidence from the survey that particular news organizations, most notably cable television news organizations such as CNN and Fox, have been at least somewhat successful in translating their offline brand to online loyalty. For the minority of online news consumers who do have a favorite site, television news organizations top the list. And among all online news consumers, television news organization websites are second in popularity behind news aggregators.

Still, it is clear that many Internet users treat news as a commodity. And if among the 35% of online news consumers who have a favorite site, only 19% would pay for access to that favorite site if it were to erect a pay wall, many must believe they could get the same information or something good enough for free elsewhere.

At the same time, those who want to find new revenue streams for news operations can take away some hope from other survey findings. Online, news consumers do not range very far. The majority say they use two-to-five sites to get their news. This could be taken as a sign that they are discriminating to a degree. If brands do not totally matter to them, well-known news organizations probably figure somewhere in that mix of “reliable” sites in consumers’ news searches. This could suggest that strategies to serve niches – to be the site that is reliable for a particular kind of information – might yield some paying customers and niche-oriented advertisers.

The PEJ-PIP survey also shows there might be rewards to news organizations that embrace social networking strategies to build audiences. Our earlier report found that news is a social currency for many people and that they rely on their friends and colleagues at times to alert them about news or help them discuss the meaning of particular news events. Eventually, the news operations that develop social networking strategies and distribution mechanisms well might be able to convince advertisers that they have special access to attractive news consumers – especially those who influence the tastes of others. That could bring in more ad revenues from firms that are keen to participate in this increasingly word-of-mouth world.

The earlier PEJ-PIP report identified two classes of especially avid news consumers whose interests are so keen that they might be coaxed into paying something for special news products that either focus on the speedy delivery of information or high-quality, high-value information. The groups were the 33% of cell-phone owners who get news on their handheld devices and the 37% of Internet users who are active participators in the news making, news delivery, and news commentary processes. It is easy to imagine that these are people for whom the economic or social or political value of being the “first to know” or the “first to comment” has real meaning. They might be willing to pay at least a bit for news organizations that can truly deliver an extra increment of speed or in-depth material that is unique.

Read the full report at www.pewresearch.org/pewresearch-org/journalism