The ongoing trade dispute between the United States and China has led both countries to announce billions of dollars’ worth of tariffs on each other’s products. China is the largest single exporter to the U.S. – more than $500 billion worth of Chinese goods entered the U.S. last year – and American tariffs on Chinese products were on the high side even before the latest round of tit-for-tat increases. But they are by no means the highest import duties the U.S. charges.

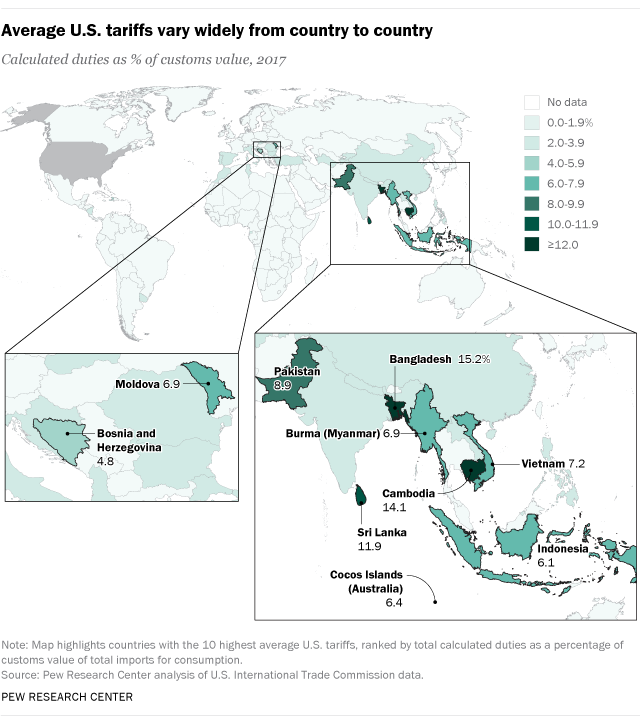

Those would be on imports from several developing South Asian nations whose exports to the U.S. are heavily weighted toward clothing and other products that the U.S. generally taxes highly. Bangladesh, for example, exported about $5.7 billion worth of goods to the U.S. last year, 95% of which were apparel, footwear, headgear and related items, according to a Pew Research Center analysis of data from the U.S. International Trade Commission. Nearly all Bangladeshi imports were subject to U.S. duty, and the tariffs on them were equivalent to 15.2% of the total value of that country’s shipments to the U.S. – the highest such average rate among the 232 countries, territories and other jurisdictions in the ITC database.

Other countries with similar profiles are Cambodia (duties equal to 14.1% of the total value of imports from there), Sri Lanka (11.9%), Pakistan (8.9%) and Vietnam (7.2%). By contrast, the duties on Chinese imports totaled $13.5 billion last year, or 2.7% of their total value. For all imports worldwide, the U.S. imposed tariffs equal to about 1.4% of total value.

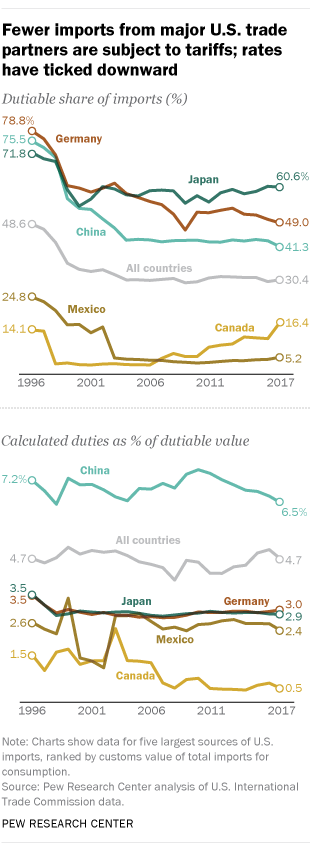

The average tariff rates the U.S. imposes on its other major trading partners are much lower than those on China. Mexico and Canada, the second- and third-highest sources of U.S. imports, had average duties last year of just 0.12% and 0.08% of the value of their imports, respectively. (The three countries are linked in the North American Free Trade Agreement.) The average rates for Japan and Germany were both less than 2%; South Korea, with which the U.S. also has a free trade agreement, had duties equal to just 0.25% on its $70.5 billion in total exports to the U.S.

Average tariff rates on U.S. imports from a given country, as defined above, depend on two things: the share of total imports that are subject to duty, and the average rate the U.S. places on that share.

In general, U.S. tariffs are lower today (relative to the total value of imports) than they were two decades ago, mainly because more imported goods are fully exempted from duties.

In 1996, for example, three-quarters (75.5%) of Chinese imports were subject to duty, at an average rate of 7.2%. Last year, only about two-fifths (41.3%) of imports from China were dutiable, with the rest entering the country duty-free; the average rate on the dutiable portion of Chinese imports was 6.5%. (Looking at the average rate on only the dutiable portion of imports – rather than on all imports – moves Bahrain, Haiti, Barbados and several other small nations to the top of the list, mainly because of relatively high rates on a relatively small portion of their total imports.)