The economic fallout from the COVID-19 outbreak has put the jobs of many American workers in jeopardy, but it has also put in doubt the economic fortunes of many of the business owners who employ them.

More than four-in-ten U.S. businesses with paid employees – 2.4 million out of the 5.3 million examined – operate in higher-risk industries likely to be affected more deeply by the COVID-19 outbreak, according to a Pew Research Center analysis of federal government data. Upwards of 1 million of these businesses are in retail trade or accommodation and food services alone, among the industries jolted by mandated closures or the need for social distancing.

How we did this

The COVID-19 pandemic is likely to have a widespread negative impact on business activity in the United States. This analysis focuses on the major demographic characteristics of business owners in the economy overall and in industries that are at higher risk of a more severe economic shock.

For this analysis, we focused on 5.3 million businesses with paid employees and which could be classified by the demographic characteristics of their owners. Collectively, these businesses employed 58.7 million workers in 2016, the latest year for which data is available. Some 270,000 businesses, employing 62.3 million workers, are excluded because they are publicly held or otherwise could not be classified by the characteristics of their owners. Overall, there are about 30 million businesses in the U.S., including the self-employed.

The industries classified as being at higher risk from the COVID-19 outbreak, and the number of businesses with paid employees in those industries in 2016, are: retail trade (650,266); transportation and warehousing (182,236); health care and social assistance (646,042); arts, entertainment and recreation (121,254); accommodation and food services (517,676); and other services, except public administration (385,357).

Estimates relating to business owners are derived from the 2016 Annual Survey of Entrepreneurs, the latest available data. Additional estimates of the workforce are from the U.S. Bureau of Labor Statistics or tabulated from the Current Population Survey (CPS). The terms “business” and “firm” are used interchangeably, as are the terms “business owner” and “entrepreneur,” and “immigrant” and “foreign born.” The term “sales” refers to either sales or receipts.

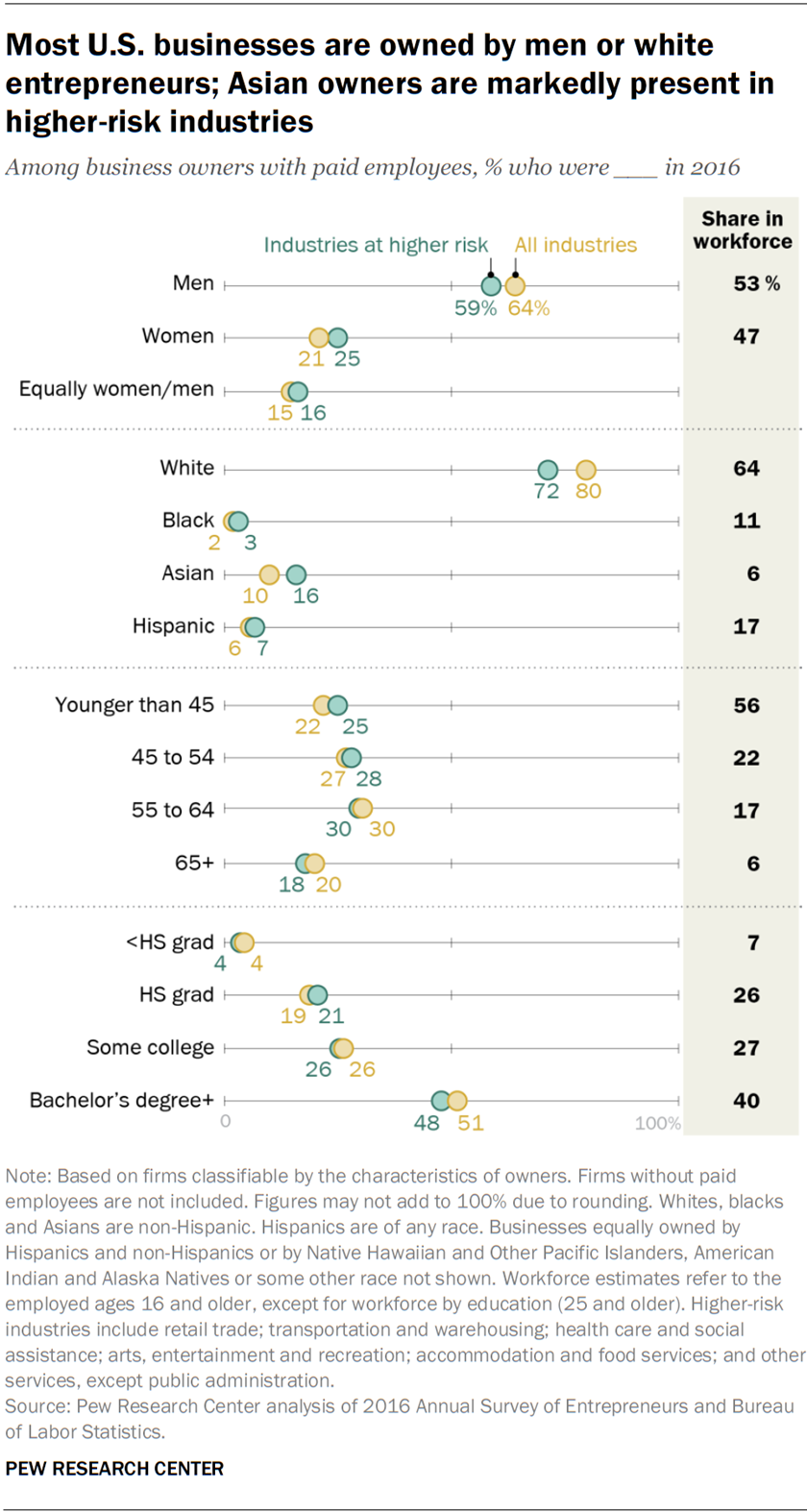

The economic risk to business owners varies by the demographic group to which they belong. Men, white or Asian entrepreneurs, people ages 55 and older and college graduates are more likely to be business owners compared with their shares in the workforce overall. At the same time, women, Asian and foreign-born entrepreneurs have a greater presence in higher-risk industries than in the economy overall.

In 2016, men were the majority owners of nearly two-thirds (64%) of businesses overall. In contrast, women were the majority owners of 21% of businesses. The remaining 15% of businesses were equally owned by men and women.

However, women have somewhat more exposure in higher-risk industries, where they were the principal owners of 25% of businesses and equal partners in another 16%. This is because of their greater role as owners in the health care and social assistance industry and in other services (excluding public administration). In these two industries, women owned 33% and 27% of businesses, respectively.

The vast majority of businesses have white owners – they hold the majority stake in 80% of businesses overall and 72% of businesses in higher-risk industries. The second largest racial or ethnic group among business owners consists of Asian entrepreneurs: They run 10% of all businesses and 16% of businesses in higher-risk industries. Asian owners have a relatively strong presence in accommodation and food services (25%), retail trade (16%) and other services (15%), elevating their financial risk from the COVID-19 outbreak.

Business owners are both older and more educated than the U.S. workforce, whether across all industries or in higher-risk industries. About half of business owners are either 55 or older or have graduated from college. By comparison, only 23% of employed workers overall are 55 or older and 40% are college graduates.

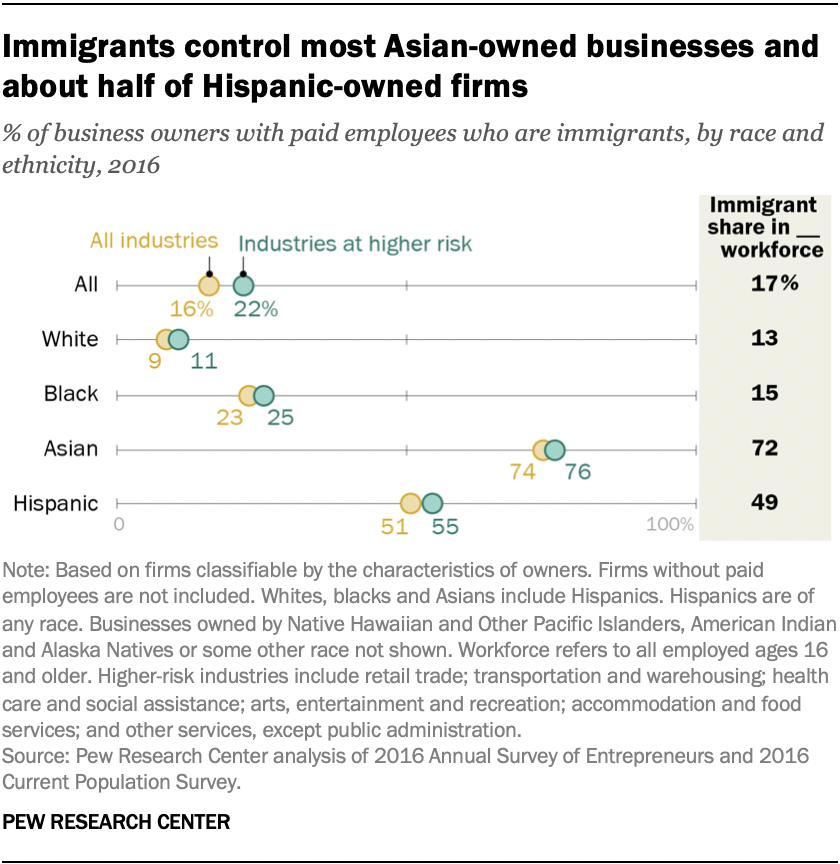

Whether as restaurant owners or as Silicon Valley entrepreneurs, immigrants represent a significant share of American business owners. Comprising 16% of all business owners, immigrants were majority owners of 22% of businesses in higher-risk industries in 2016. The principal reason for this is their entrepreneurship in accommodation and food services, an industry in which immigrants own 33% of businesses.

Hispanic and Asian immigrant business owners face significant exposure from the coronavirus-induced economic downturn. They accounted for 51% of all Hispanic-owned businesses and 74% of Asian-owned businesses in 2016, shares similar to the percentages of Hispanic and Asian workers who are immigrants.

Meanwhile, entrepreneurship among black immigrants exceeds their role in the U.S. workforce. Immigrant owners accounted for about one-fourth of black-owned businesses in the economy overall (23%) and in higher-risk industries (25%). These shares are much higher than the share of immigrants in the black workforce overall (15%).

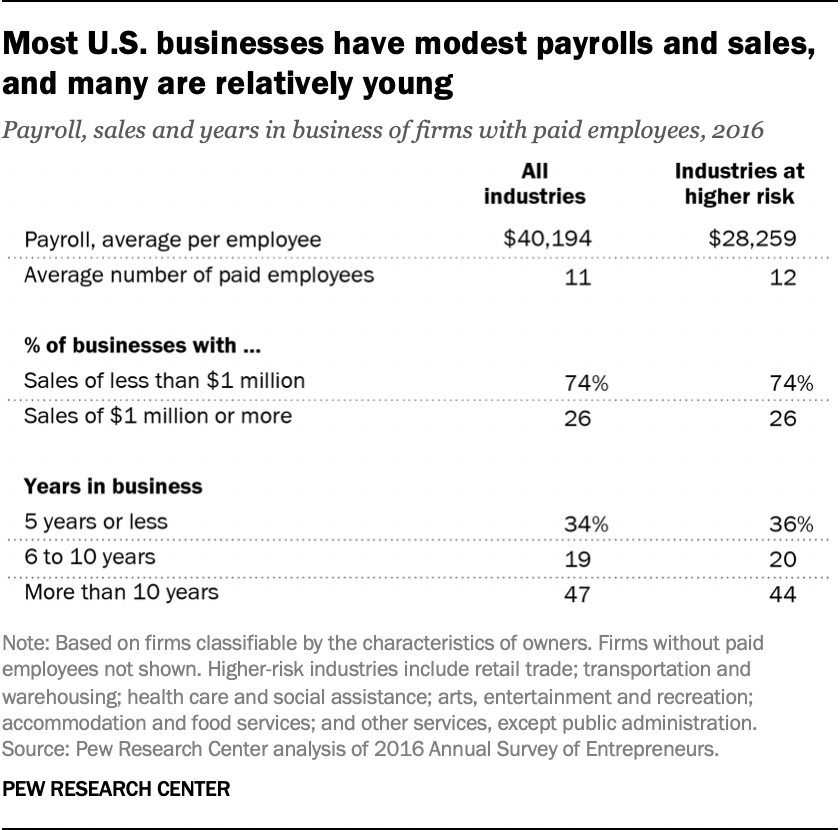

It is not known exactly which businesses will survive the economic fallout from the COVID-19 outbreak or the extent to which government lending programs will keep them afloat. Most businesses with paid employees have small payrolls and modest revenues. Many are relatively young. A report from the Federal Reserve Bank of New York finds that the financial health of smaller firms, younger firms and firms with black or Hispanic owners is weaker than that of other firms. Even in normal times, only about half of business establishments are estimated to survive five years or more. A recent survey of small businesses found that 43% are temporarily closed due to the effects of the COVID-19 outbreak. What might matter most is the duration of the economic slide and whether it resembles the aftershock of a natural disaster or a deep cyclical downturn.