More than a year after the coronavirus outbreak began, many Black Americans continue to reel from the economic fallout. Nearly half of Black adults say the economic impact of the pandemic will make achieving their financial goals harder in the long term. And four-in-ten Black adults live in households that have lost jobs or wages since the start of the coronavirus outbreak.

Despite the pandemic’s widespread financial harm, the impact on Black Americans has varied, with the college educated and those who are older faring slightly better than those with lower levels of education and younger Black adults.

Pew Research Center conducted this study to better understand Black Americans’ financial outlooks and how their personal financial situations have changed amid the coronavirus outbreak. It is part of a larger study about the economic impact of COVID-19 and is based on a survey of 10,334 U.S. adults in January 2021, including 934 Black adults. Everyone who took part is a member of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way, nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology.

Here are the questions used for this report, along with responses, and its methodology.

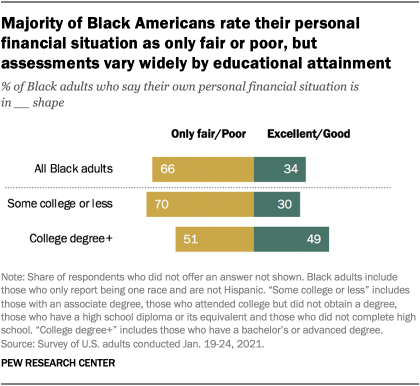

About one-in-three Black Americans (34%) say their personal financial situation is either in excellent or good shape, compared with 53% of U.S. adults overall, according to a Pew Research Center survey conducted Jan. 19-24, 2021. But among Black Americans, this assessment varies sharply by educational attainment. Roughly half of Black adults (49%) with a college degree say their personal financial situation is in excellent or good shape, compared with 30% of those with some college experience or less who say the same.

Black Americans have faced a sharp rise in unemployment and wage loss due to the pandemic, which has impacted their savings habits. Some 44% of Black adults who are typically able to save money say they have put less money into savings than usual. Half of Black adults with some college experience or less say they’ve saved less than usual, while about a quarter (27%) of those with a college degree say the same. And just 18% of Black adults without a degree say they have been putting more into savings, compared with 33% of those with a college degree who say this.

Black adults both with and without a college degree say they are spending less money than usual since the coronavirus outbreak began in February 2020 (46% and 39% respectively). However, their reasons for spending less differ significantly. Roughly four-in-ten Black adults (43%) with some college experience or less say they are spending less because they are worried about their personal finances, compared with 22% of Black adults with a college degree who say the same. Over half (56%) of Black adults with some college experience or less say they are spending less money because their daily activities have changed due to coronavirus-related restrictions. By contrast, nearly eight-in-ten Black adults (77%) with a college degree or higher say this.

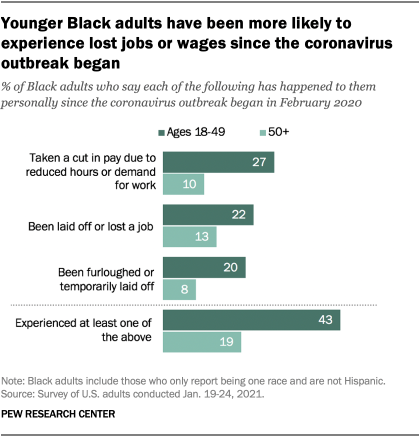

Since the outbreak began, about four-in-ten Black adults (43%) under 50 say they have experienced some form of job or wage loss, compared with only 19% of Black adults 50 and older. About three-in-ten Black adults (27%) under age 50 reported a cut in pay due to reduced hours or demand for their work, higher than the 10% of Black adults 50 and older who took a pay cut. And around two-in-ten Black adults under 50 have either been laid off or lost a job (22%) or been furloughed or temporarily laid off (20%), a higher share than among those 50 and older (13% and 8%, respectively).

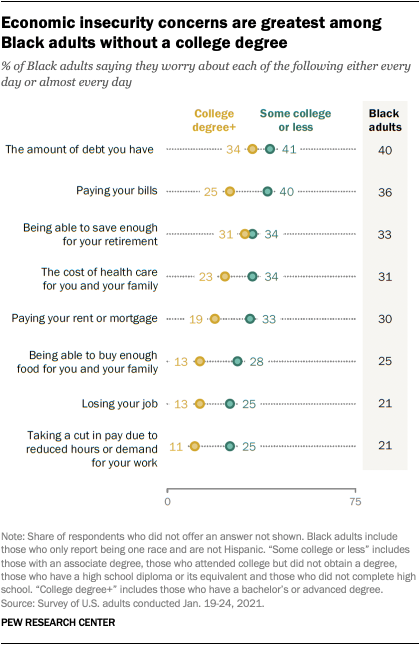

A year into the pandemic, Black Americans with a college degree express less economic worry than Black adults with some college experience or less. For example, four-in-ten Black adults with some college experience or less worry about paying their bills every day or almost every day, compared with a quarter of Black adults with a college degree. One-in-three Black adults (33%) with some college experience or less worry about paying their rent or mortgage, compared with 19% of Black adults with a college degree. And one-in-four Black adults with some college experience or less worry about losing their job or taking a cut in pay (each 25%) – higher shares than among Black adults with a college degree (13% and 11%).

Still, some financial fallout from the outbreak affects Black adults across education levels and ages. Those with and without a college degree are just as likely to say the economic impact of the coronavirus outbreak will make achieving their financial goals harder (45% and 49%, respectively). Likewise, about half of Black adults under 50 years old and those 50 and older (48% each) express the same sentiment.

Note: Here are the questions used for this report, along with responses, and its methodology.

CORRECTION (June 17, 2021): The following sentences have been updated: “Some 44% of Black adults who are typically able to save money say they have put less money into savings than usual. Half of Black adults with some college experience or less say they’ve saved less than usual, while about a quarter (27%) of those with a college degree say the same.” The percentage point and language changes are from including an expanded survey respondent universe. This change did not affect the post’s substantive findings.