Most Black adults say their household finances meet basic needs with either a little or a lot left over for extras, even amid economic disruptions due to COVID-19. Yet financial challenges exist. Fewer than half of Black adults say they have an emergency fund, and some have taken multiple jobs to make ends meet, according to a recent Pew Research Center survey of Black Americans.

The survey also finds that Black Americans typically experience higher levels of economic insecurity than Americans overall. This insecurity has worsened during the coronavirus pandemic amid health and financial challenges, which include a relatively high unemployment rate for Black workers.

Yet within the Black population, the economic experiences of Black Americans have long varied due to income and economic inequality. Before the pandemic, the top 10 percent of households headed by Black adults earned 14 times the amount of Black households in the bottom 10%, a gap that has grown over the decades.

This analysis draws on Pew Research Center’s second in-depth survey of Black Americans, which examines the rich diversity of Black people in the United States and their life experiences. (Read findings from the first survey in “Faith Among Black Americans.”) Amid the growing debate over income inequality, the survey explores how Black Americans view their household finances, how prepared they are for an unexpected emergency, and if they have taken multiple jobs at once to make ends meet.

The online survey of 3,912 Black Americans was conducted Oct. 4-17, 2021. The data was collected as part of a larger survey that included a total of 6,513 U.S. adults. The survey includes 1,025 Black adults on the Center’s American Trends Panel (ATP), and 2,887 Black adults on Ipsos’ KnowledgePanel. Respondents on both panels are recruited through national, random sampling of residential addresses.

Recruiting panelists by phone or mail ensures that nearly all U.S. adults have a chance of selection. This gives us confidence that any sample can represent the whole population (see our Methods 101 explainer on random sampling). Here are the questions used for this survey, along with its responses, and its methodology.

To create the upper-, middle- and lower-income tiers, respondents’ 2020 family incomes were adjusted for differences in purchasing power by geographic region and household size. Respondents were then placed into income tiers using a similar methodology to the Center’s previous work on the American middle class: Middle income is defined as two-thirds to double the median annual income for the entire survey sample. Lower income falls below that range, and upper income lies above it. For more information about how the income tiers were created, read the methodology.

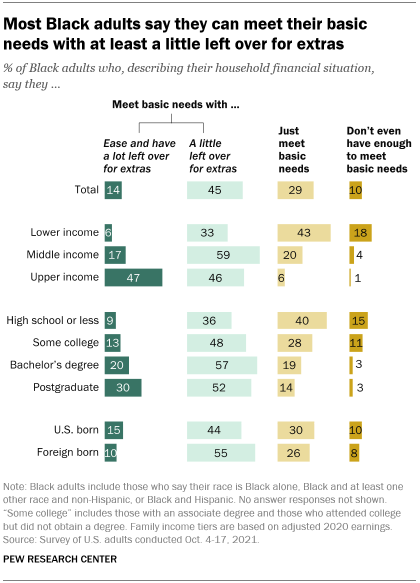

The long-standing differences in economic experiences among Black Americans remain today. According to the October 2021 survey, about two-in-ten Black adults with lower incomes (18%) say they don’t even have enough to meet basic needs, and another four-in-ten (43%) describe their household finances as just meeting their basic needs. Black adults with higher incomes report a starkly different situation: Only 4% of Black adults with middle incomes and 1% of those with upper incomes say they don’t have enough to meet basic needs.

At the same time, most Black adults with middle and upper incomes say their household finances cover basic needs with some left over for extras. Roughly three-quarters (76%) of Black adults with middle incomes say this, as do 93% of Black adults with upper incomes. Meanwhile, just 38% of Black adults with lower incomes say their household finances meet basic needs with money left over. And while relatively few Black adults overall say their households have a lot left over for extras (14%), nearly half (47%) of Black adults with upper incomes say this, highlighting a diverse range of economic experiences among Black people.

Economic experiences also vary widely by educational attainment. A majority of Black adults with a postgraduate degree (82%), a bachelor’s degree (77%) or some college experience (61%) say their household finances are enough to have a little or a lot left over for extras. This share drops to 44% among Black adults with a high school diploma or less education.

Most Black adults do not have an emergency fund

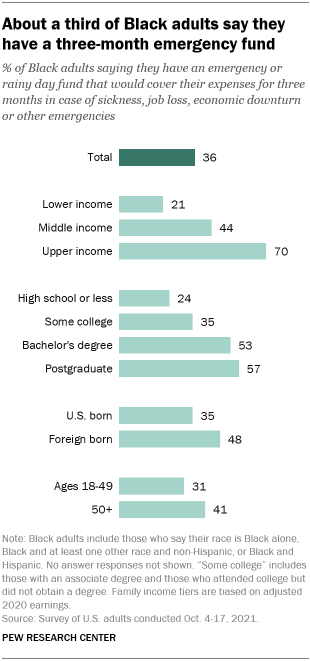

While most Black adults say their household finances meet basic needs with some left over for extras, just 36% say they have an emergency or rainy day fund to cover three months of expenses in case of sickness, job loss, economic downturn or other emergencies. But there are wide disparities across family income tiers and educational attainment levels.

Seven-in-ten Black adults with upper incomes say they have an emergency or rainy day fund to cover three months of expenses in case of an emergency, more than three times the share (21%) of Black adults with lower incomes who say the same. Among Black adults with middle incomes, fewer than half (44%) have an emergency fund.

Similarly, about a quarter (24%) of Black adults with a high school diploma or less say they have a three-month emergency fund, while roughly a third (35%) of Black adults with some college experience say the same. The gap between those with at least a college degree is smaller: 53% of Black adults with a bachelor’s degree and 57% with a postgraduate degree say they have an emergency fund.

An April 2020 Pew Research Center survey found only 27% of non-Hispanic Black adults said they had an emergency or rainy day fund that would cover their expenses for three months in case of emergency. Since then, the share of non-Hispanic Black adults with an emergency fund has grown to 35%.

For Black adults with more than one job, multiple incomes often essential to meeting basic needs

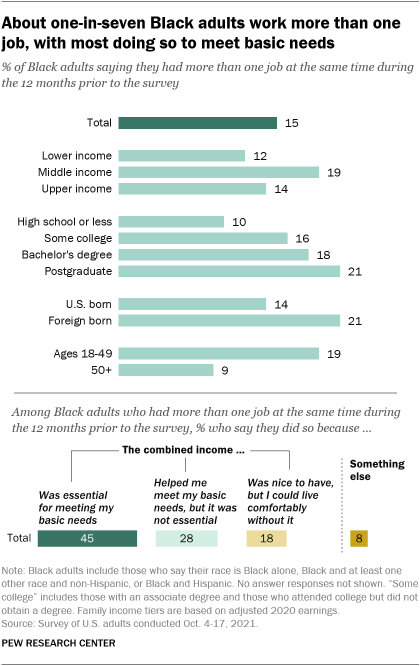

About 15% of Black adults say they have worked more than one job at the same time in the 12 months prior to the survey. Among those who have, 45% say they did so because the combined income was essential, and another 28% say the combined income helped meet basic needs.

The share of Black Americans who worked multiple jobs differs across demographic subgroups.

Black adults with a postgraduate degree are among the most likely educational subgroups to say they worked more than one job at the same time – 21% say this. Meanwhile, 18% of Black adults with a bachelor’s degree and 16% with some college experience worked multiple jobs at once. Just 10% of Black adults with a high school diploma or less say they worked multiple jobs at the same time.

By contrast, roughly one-in-ten Black adults with lower incomes (12%) and upper incomes (14%) say they worked more than one job at the same time, while 19% of Black adults with middle incomes say the same.

And when it comes to immigration status, roughly two-in-ten Black adults who were born in another country (21%) say they worked more than one job at the same time in the 12 months prior to the survey, compared with 14% of Black adults who were born in the United States.

Black Americans face more economic insecurity than Americans overall

The survey also finds Black Americans are less secure in their finances than Americans overall: 60% of Black Americans say their household finances meet basic needs with at least a little left over for extras, compared with 71% of all Americans. Similarly, while 36% of Black Americans have a three-month emergency fund, 54% of all Americans say they have one. Similar gaps between the groups exist across all major demographic subgroups.

However, Black Americans are just as likely as Americans overall to say they have worked more than one job at the same time in the 12 months prior to the survey – 15% of each group says so. Among those who have held more than one job at the same time, large majorities of Black Americans and U.S. adults overall (73% vs. 67%) say they did so to meet basic needs.

Note: Here are the questions used for this survey, along with its responses, and its methodology.