I. Overview

A small but significant decline has occurred during the current recession in the share of Latino immigrants active in the U.S. labor force, according to a Pew Hispanic Center analysis of Census Bureau data. In a year when jobs have become scarce for everyone, the proportion of working-age Latino immigrants participating in the labor force has fallen, at least through the third quarter of 2008, while the proportion of all non-Hispanics as well as of native-born Hispanics has held steady.

Jobs attract many Hispanic immigrants to the United States, and their labor force participation rate — the proportion of the working-age population that is either working or actively seeking work — is typically higher than the rate in the native-born population. That remains the case now.

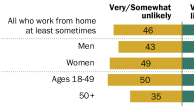

However, among Latino immigrants, 71.3% were in the labor force at the close of the third quarter of 2008, compared with 72.4% a year earlier. This 1.1 percentage point decrease follows on the heels of a steady increase in the labor force participation rate of foreign-born Latinos since 2003 when the economy started its recovery from the 2001 recession.1 The drop in labor market activity was about twice as high among immigrants from Mexico and among immigrants who arrived in the U.S. since 2000. Among all non-Hispanics, the labor force participation rate was essentially unchanged during this period — it was 66.2% at the end of the third quarter of 2008, up marginally from 66.0% a year earlier. Among native-born Hispanics, the rate was 66.4%, up from 66.0% a year earlier.

The absolute number of immigrant Latinos in the labor force did increase slightly — by 150,000 — between the third quarters of 2007 and 2008. But this increase is much smaller than it had been in previous years. And because it is also much smaller than the growth in the working-age population of Latino immigrants, the share that is active in the labor force has declined.

It is not possible to conclude from these data whether or not some of the foreign-born Latinos who left the labor force have returned to their countries of origin. The growth in the immigrant Latino population has leveled off in recent years, but it is not clear whether this has been due to an increased outflow of migrants. Passel and Cohn (2008) do find a decrease in the annual inflow of undocumented migrants to the U.S. since 2005. About four-in-five undocumented migrants come from Latin America.

The labor market data do not paint an unrelentingly negative picture for Latino immigrants, who make up about 8% of the total U.S. labor force. Their unemployment rate in the third quarter of 2008 was 6.4%, not much higher than the 6.1% rate for the total U.S. workforce and much lower than the 9.6% rate for native-born Hispanics (who account for about 45% of the Hispanic labor force in this country). However, workers who withdraw from the labor force are not counted among the unemployed. If foreign-born Latinos had remained as active in the labor market in 2008 as they were in 2007, their unemployment rate would be much higher today.

This report analyzes labor market outcomes for workers using a variety of indicators. Some labor market indicators, such as the working-age population (those 16 and older) and the size of the labor force (those either employed or actively seeking work), respond principally to demographic forces. For immigrants, economic forces may play a stronger role in shaping the working-age population and labor force by triggering changes in inflows and outflows of migrants. Tracking those indicators establishes the size of a racial or ethnic group in the labor market and whether its relative size is expanding or shrinking.

Other important labor market indicators respond principally to economic developments. Those include employment levels and the employment, unemployment and labor force participation rates. The employment rate is the percentage of the working-age population that is employed and the unemployment rate is the percentage of the labor force that is unemployed and looking for work. Tracking those indicators, along with estimating wages, is the key to understanding economic outcomes for workers.

The data for this report are derived from the Current Population Survey, a monthly survey of about 55,000 households conducted jointly by the Bureau of Labor Statistics and the Census Bureau. Data from three monthly surveys were combined to create larger sample sizes and to conduct the analysis on a quarterly basis.

A Note on Terminology

The terms “Hispanic” and “Latino” are used interchangeably in this report. The terms “whites,” “blacks” and “Asians” are used to refer to the non-Hispanic components of their population.

Foreign-born refers to an individual who is born outside of the United States, Puerto Rico or other U.S. territories and whose parents are not U.S. citizens.

The terms “jobs” and “employment” are used interchangeably in the report although they are not necessarily the same — a single worker can hold more than one job, and a job can be filled by more than one worker

Unless otherwise indicated, estimates are not seasonally adjusted.

Most of the analysis discusses changes in labor market indicators from the third quarter of 2007 to the third quarter of 2008. The shorthand “in the recession” or “in the past year” is used to refer to changes in those time periods.

Recommended Citation

Kochhar, Rakesh. “Latino Workers in the Ongoing Recession: 2007 to 2008,” Pew Hispanic Center, Washington, D.C. (December 15, 2008).