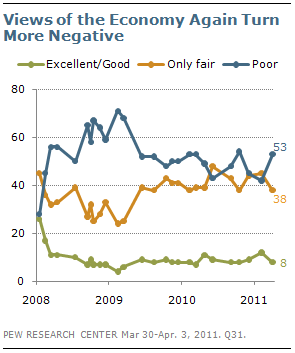

The public’s views of the national economy began to move in a less negative direction late last year. The proportion rating the national economy as poor fell from 54% in October to 45% in December. That trend continued through February, when 42% said economic conditions were poor.

But in the new survey, the number saying economic conditions are poor has again climbed; currently, 53% say the economy is poor, up 11 points from February. Fewer people rate the economy as only fair (38% now, down from 45% in February). As has been the case for the past three years, very few (8%) say that economic conditions are excellent or good.

Negative views of economic conditions have increased among most demographic and political groups. But independents are especially gloomy about the state of the economy: 57% say economic conditions are poor, up from 43% in February. A comparable percentage of Republicans (59%) also views the economy as poor, which is little changed from February (51%). Democrats’ views of the economy have

shown less change and are more positive than those of Republicans or independents (41% poor now, 36% in February).

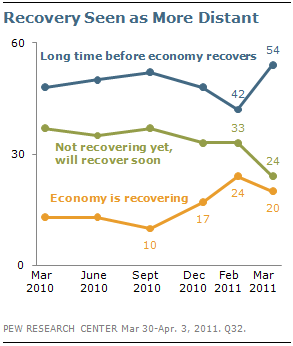

Since February, there also has been a decline in the number saying the economic recovery is already occurring or will kick in soon. Two months ago, a majority (57%) said the economy was recovering (24%) or that the economy would recover soon (33%).

Only about four-in-ten (42%) said it would be a long time before the economy recovered.

Today, more (54%) say the recovery is a long way off than say either it is already recovering (20%) or will recover soon (24%).

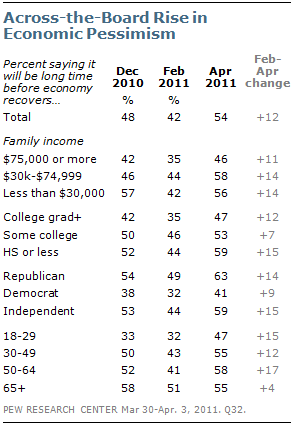

The rise in economic pessimism since February has come across nearly all political and demographic groups. And in most cases, people are about as likely to see recovery as a long way off as they did in December.

Just as independents’ views of current economic conditions are comparable to Republicans’ assessments, their economic expectations are similar as well. Currently, 59% of independents and 63% of Republicans say it will be a long time before the economy recovers; that compares with 41% of Democrats. In February, 49% of Republicans, 44% of independents and 32% of Democrats said the recovery was a long way off.

More Expect Family Financial Situation to Worsen

The public continues to give rather dour assessments of their own personal financial situation. Most rate their finances as either only fair (36%) or poor (26%); 29% say they are in good shape and just 7% say they are in excellent shape financially. Personal financial ratings have shown little change over the past several months.

At the same time, people’s financial outlooks for the next year have become somewhat more negative since December. Just over half (51%) say they expect their financial situation to improve a lot (7%) or some (44%) over the next year. However, the percentage saying they expect it to get a little or a lot worse has grown from 26% in December to 33% in the current survey.

The increase in financial pessimism has come entirely among those in middle- and lower-income groups. Currently, 35% of those with family incomes of between $30,000 and $75,000 expect their finances to get worse, up from 25% in December. There has been a similar increase among those with family incomes of less than $30,000 (from 29% to 39%).

By contrast, those earning $75,000 or more a year have experienced no change in expectations and remain far less likely to say they expect their situation to worsen (23% compared with 35% and 39%, respectively).

Republicans have also become more pessimistic about the outlook for their family’s finances over the next year. Roughly a third (36%) expects their situation to get worse over the next year up from 26% in December. There have been no significant changes among Democrats or independents.

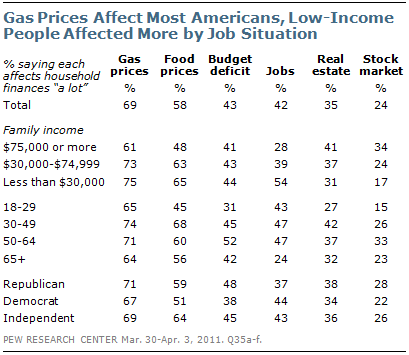

Gas Prices Top Household Financial Pressure

Gas prices affect the household finances of most Americans, regardless of their age, income or political affiliation. Fully 69% of the public and majorities across demographic and political groups say that gas prices affect their household finances a lot.

Aside from gas prices, however, there is less common ground in views of different financial pressures. While large majorities of those with low (65% of those with less than $30,000) and middle family incomes (63% of those with $30,000 to $75,000) say their finances are affected a great deal by prices for food and other consumer goods, fewer of those with higher incomes agree. About half (48%) of those with incomes of $75,000 or more say their finances are affected a lot by food and consumer prices.

Jobs are a particular concern for those with lower incomes: 54% of those with incomes of below $30,000 say the job situation say their household finances are affected a lot by the job situation, the highest in any other income category. Conversely, the stock market is a greater concern for those with incomes of at least $75,000 than it is for those in lower income groups.

The budget deficit is generally viewed as a secondary financial concern, though more Republicans and independents than Democrats say the deficit affects their household finances. Nearly half of Republicans (48%) and 45% of independents say their household finances are affected a lot by the budget deficit; fewer Democrats (38%) express this view.