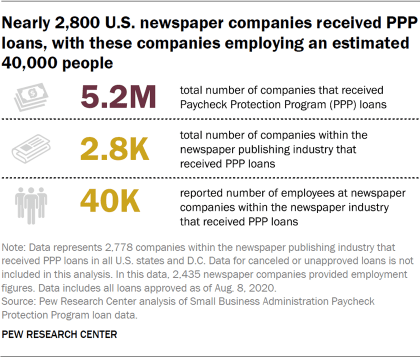

As the coronavirus pandemic continues to wreak havoc on an already struggling newspaper industry and talks about further economic stimulus continue to stall, nearly 2,800 newspaper companies received Paycheck Protection Program (PPP) loans from the U.S. government as of this past August, according to a new Pew Research Center analysis of Small Business Administration (SBA) data.

This is a sliver of the roughly 5.2 million PPP loans that have been lent out to small businesses – but represents a large segment of newspaper companies. According to the most recent data from the U.S. Census Bureau’s Statistics of U.S. Businesses, there were 4,166 U.S. companies in the newspaper publishing industry in 2016, and these companies collectively employed nearly 180,000 people.

This analysis is based on publicly released data published by the Small Business Administration (SBA) and includes all approved Paycheck Protection Program (PPP) loans issued to companies in the newspaper publishing industry as of Aug. 8, 2020. Companies in the newspaper publishing industry were eligible to apply for PPP loans if they had been affected by the coronavirus outbreak and employed fewer than 1,000 people. Specifically, the companies included in this analysis are any businesses that self-identified as being part of the newspaper industry and are responsible for producing and distributing newspapers, including gathering news; writing news columns, feature stories and editorials; and selling and preparing advertisements. They may publish newspapers in either print or electronic form.

This data represents less than 1% of the more than 5.2 million loans approved under the Paycheck Protection Program. Data for canceled or unapproved loans is not included in this analysis. To protect the privacy of borrowers, specific loan amounts were not made available by the SBA; rather, loans were reported as ranges in the data, and this is reflected in this analysis. The number of employees by PPP loan referenced in this analysis refers to the number of employees reported by the borrower and may not necessarily reflect the number of workers kept employed with PPP funds. About 12% of newspaper companies that received loans did not list any employees.

Working with external and large datasets requires, at the outset, critical and often complex structural and methodological decisions, as well as a major time investment in data organization and data cleaning. Researchers took multiple steps to review and clean the data, especially in cases where some discrepancies or errors were spotted. The objective was to obtain a clean dataset that is as complete as possible about the PPP loans given to newspaper businesses. Read more information about the Paycheck Protection Program as well as the data used in this analysis.

The methodology for this analysis can be found here.

The Paycheck Protection Program was established back in March 2020 as part of the CARES Act, a federal coronavirus aid package, to help small businesses pay employees and other expenses. These loans were designed to be forgiven if certain employee retention criteria were met and if the funds were used for eligible expenses.

Any company that self-identified as a newspaper publisher, was affected by the coronavirus outbreak and employed fewer than 1,000 employees was eligible to apply. The cap of 1,000 employees means that many local newspapers owned by larger companies such as Gannett or McClatchy were not eligible to apply. The qualifying rules also mean that some companies that are part of the newspaper publishing industry but are not traditionally thought of as newspapers, such as The Chronicle of Higher Education, are included in the data.

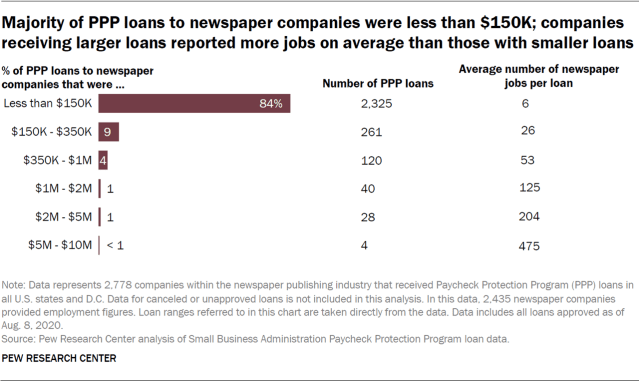

The vast majority of these PPP loans were relatively small in size. About eight-in-ten (84%) were for less than $150,000, 9% ranged from $150,000 to $350,000, 4% were between $350,000 and $1 million, and about 3% were $1 million or more. This was about on par with PPP loans across all industries, of which 87% were less than $150,000, according to the SBA. In the data released by the SBA, loans were broken out into six different ranges and these ranges are used throughout this report.

The largest PPP loans – those for $5 million or more – mainly went to bigger regional newspaper companies, such as Seattle Times Co., Newsday LLC and Times Publishing Co. (publisher of the Tampa Bay Times).

Out of the 2,778 self-identified newspaper companies that received PPP loans, 2,435 provided employment figures. In total, that amounted to an estimated 40,236 employees, with an average of 14 employees per loan. Companies that received loans that were less than $150,000 reported six jobs per loan on average, those with loans in the $150,000-$350,000 range reported 26 jobs on average and companies with loans ranging from $350,000 to $1 million reported 53 on average. Companies with loans issued for more than $1 million tended to have more jobs per loan on average, but these larger loans made up only a small share of the total number issued. Since 12% of newspaper companies that received PPP loans did not report their number of employees, it is likely that the number of newspaper employees within companies that received loans is higher.

Looking at the geographic distribution of PPP loans, more loans went to newspaper companies in states with larger populations, with newspaper companies in medium or smaller states receiving fewer loans. Indeed, about one-in-five (21%) of all PPP loans went to newspaper companies operating in three states: Texas (8%), California (7%) and New York (6%). Delaware, Rhode Island and Hawaii were the three states with the fewest PPP loans to newspaper publishers, with less than 1% of the loans going to those states. Several factors might explain why newspaper companies in larger states received more loans, ranging from the fact that larger states in general received overall more PPP loans, to previous research that has shown that more newspapers exist in more populous states and newsroom employment overall tends to be concentrated in certain geographical areas.

Note: Here is the methodology for this report.