The Census Bureau reported today that the nation’s poverty rate grew to 15.1% in 2010, an increase for the third year in a row, and that median household income declined in 2010. Pew Research Center reports have documented the impact of the Great Recession and shaky recovery on Americans’ wealth, work lives, personal finances and emotional well-being–finding, for example, that more than half of working Americans report a job-related hardship. Recent public opinion surveys by the Pew Research Center for the People & the Press have found that Americans are wary of providing increased spending for the poor and needy.

One recent analysis concluded that the gap in wealth between white households and households of blacks and Hispanics was the largest in 2009 since the government began publishing data on this topic a quarter century ago. The data on wealth—that is, assets minus debts—come from the Census Bureau’s Survey of Income and Program Participation. According to the report, about a quarter of all Hispanic (24%) and black (24%) households in 2009 had no assets other than a vehicle, compared with just 6% of white households.

Most Workers Report a Job-Related Hardship

A Pew Research Center survey of the general public in May 2010—during the period covered by the new census figures on poverty, income and health insurance—found that more than half the adults in the U.S. labor force (55%) suffered a work-related hardship since the recession began. These hardships included involuntary reduction in work hours, a pay cut, unpaid leave, a switch to part-time work, underemployment or unemployment, according to the report, How the Great Recession Has Changed Life in America.

In addition to looking at work-related consequences of economic hard times, the report also analyzes the recession’s impact on personal finances; about half of households say they are in worse shape than before the recession began in 2007. The report explores other ways people have been affected, including 27% who say they have had trouble paying medical bills and 49% who loaned money to someone. And it describes Americans’ increased pessimism about their children’s future.

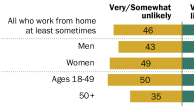

As the report points out: “While nearly all Americans have been hurt in one way or another, some groups have suffered more than others. Blacks and Hispanics have borne a disproportionate share of both the job losses and the housing foreclosures. Young adults have taken the biggest losses on the job front. Middle-aged adults have gotten the worst of the downturn in house values, household finances and retirement accounts. Men have lost many more jobs than women. And across most indicators, those with a high school diploma or less education have been hit harder than those with a college degree or more.”

Report on the Long-Term Unemployed

Because long-term unemployment is a notable feature of the recession and fragile recovery that followed it, another Pew Research Center report looks at the characteristics and attitudes of Americans who have been unemployed for more than six months. Compared with Americans out of work for shorter periods, the long-term unemployed are more likely to report a strain in family relations, loss of self-respect and loss of contact with friends, according to Pew Research survey data on this group. In addition to these reports, the Pew Research Center has released analysis about other changing social indicators associated with economic hard times. These include an increase in the share of children being raised by their grandparents, as well as a decline in the U.S. birth rate that is linked to the recession. A 2010 report explores the rising number of Americans who live in multi-generational households, a trend with links to the recession.

Public Wary of Spending for the Poor

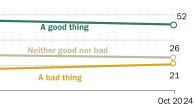

Three recent surveys by the Pew Research Center for the People & the Press focus on public opinion about spending on poor people and the priority that their needs should have in Washington. The surveys find that a majority of Americans are opposed to increased spending on the poor and needy, and that programs for this group are not considered a top priority for the president and Congress. Although there are Republican-Democrat divides on these questions, there also are fissures within each party. In a survey taken Feb. 22-March 1, 51% of Americans agreed with the statement: “The government can’t afford to do much more to help the needy.” This was the first time a majority expressed this view in the 15 years this study has been conducted. (See question 17 for the trends in public response.) Although Republicans are more likely to express this view than Democrats, there are divides within each party on the question of helping the needy.

The Pew Research Center’s annual survey of Americans’ to-do list for the president and Congress indicated that the economy and jobs dominate the public’s priorities for government in 2011, with other major issues—including problems of the poor—viewed as less important. Only 52% in that survey taken in early January say “dealing with the problems of the poor and needy” should be a top priority for the president and Congress. By contrast, the economy is rated a top priority by 87% of Americans, and jobs by 84%. The share calling the poor and needy a top priority was unchanged from 2010, but lower than it had been in 2005, before the recession began, when 59% rated the poor and needy a high priority. A decade ago, in 2001, dealing with the problems of the poor and needy was considered a top priority for the president and Congress by 63% of Americans.

A Pew Research Center survey in July asked Americans’ opinions on Medicaid, the health insurance program for low-income Americans. The view that major changes are needed in Medicaid is more widely held among Republicans than among Democrats. Republicans have lower assessments than Democrats when asked whether Medicaid has been good for the country. There is a similar partisan divide about whether states should be allowed to cut back Medicaid benefits to deal with budget problems; overall, most Republicans endorse this idea and most Democrats do not. On this question, however, there also is a divide among Republicans and those who lean Republican: Most Republicans or GOP leaners with annual incomes of $30,000 and higher say states should be allowed to cut benefits, but most Republicans or GOP leaners with incomes below $30,000 disagree.