An older worker refers to an employed person age 65 or older.

A younger worker refers to an employed person age 25 to 64.

The workforce refers to the employed population ages 16 and older.

The labor force includes all who are employed and those who are unemployed but looking for work.

Full-time work is defined as 35 hours a week or more.

References to White, Black and Asian Americans include those who report being only one race and are not Hispanic. Hispanics are of any race. The Current Population Survey did not include Asian as a separate racial category until 2003, and data for Hispanics is not available until 1971.

Numbering roughly 11 million today, the older workforce has nearly quadrupled in size since the mid-1980s. The increase is driven in part by the growth of the 65-and-older population. The bulk of the Baby Boom generation has now reached that threshold.

But, as prior Pew Research Center analysis has shown, the growth in the older workforce is driven by more than sheer numbers.

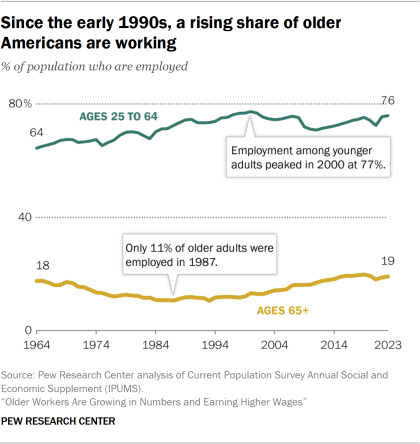

The share of older adults holding a job today is much greater than in the mid-1980s. Some 19% of adults ages 65 and older are employed today. In 1987, only 11% of older adults were working. Today’s share is similar to that of the early 1960s, when 18% of older Americans worked.

As the employment rate among older adults has gradually risen since the 1990s, employment among younger workers has followed a different pattern. Jobholding among 25- to 64-year-olds peaked at 77% in 2000, fell during the Great Recession and has rebounded somewhat since then.

Employment among men ages 25 to 54 has been sinking for decades, according to the Council of Economic Advisers. Until 2000, this was offset by rising employment among women. Women’s employment rates peaked around 2000, so overall jobholding among the younger population has not returned to its 2000 level.

Several factors have contributed to the growing share of older adults who are working. Among them:

The 75-and-older workforce

Workers ages 75 and older are the fastest-growing age group in the workforce, more than quadrupling in size since 1964. Some 9% of adults ages 75 and older are employed today, about twice the share who were working in 1987 (4%). Workers ages 75 and older are paid slightly less than older workers overall ($20 per hour at the median vs. $22 for all workers ages 65 and older). Still, they have experienced similar wage growth since 1987 as workers ages 65 and older.

- Today’s older Americans tend to have higher education levels than older workers did in the past. Adults with higher levels of education are more likely to be employed than adults with less education.

- Older adults are healthier and less likely to have a disability than in the past, making it possible to extend their working lives.

- Retirement plans have evolved. Employers have shifted their retirement plan offerings toward defined contribution plans such as 401(k)s and away from defined benefit plans. The old-style pensions incentivized workers to retire at a specific age, whereas defined contribution plans do not encourage early retirement.

- Policy changes have discouraged early retirement. Changes to the Social Security system, which raised the age that workers receive their full retirement benefits from 65 to 67, likely have encouraged older adults to delay retirement and continue working, according to labor economists.

- The nature of jobs has changed. Older workers strongly prefer jobs that entail less strenuous physical activity and allow for greater independence and more flexible work schedules. Recent research shows that many occupations, on average, have become more “age friendly” since 1990. Among the most age-friendly jobs are guide, insurance salesperson, proofreader and financial manager, none of which involve heavy physical exertion.

For some older adults who are working, their job or career may be different from what they did when they were younger. Some even consider themselves retired. Economists often refer to these post-retirement jobs as “bridge jobs.”

A recent Federal Reserve survey found that 45% of employed older adults consider themselves to be retired. Retired older workers are much more likely to work part time than their nonretired counterparts. And many older workers (25%) are receiving income from retirement accounts, pension plans or annuities (not including Social Security).

What might the future hold for older workers?

U.S. Bureau of Labor Statistics (BLS) projections show that the role of older workers will continue to grow over the next decade. Adults ages 65 and older are projected to be 8.6% of the labor force (those working and looking for work) in 2032, up from 6.6% in 2022. Older adults are projected to account for 57% of labor force growth over this period.

Older adults are one of the few age groups that are expected to increase their labor force participation rate over the decade. The BLS projects that 21% of older adults will be in the labor force in 2032, up from 19% in 2022. The only other age group projected to increase its labor force participation rate is 55- to 64-year-olds.

Older adults are less likely to perform gig activities

Most of this report focuses on traditional employment measures – that is, working for pay or profit – and does not capture participation in the “gig economy.” A recent Federal Reserve survey asked adults if they engaged in any gig activities over the prior month. Gig activities include selling items at a garage sale or online marketplace, short-term rentals of property, and freelance gig work such as ride-sharing.

- About 10% of adults ages 65 and older said they performed any gig activities in the previous month, compared with 17% of younger adults.

- Most gig workers do not receive the majority of their income from gig activities. Only 7% of older gig workers say that more than half their income from the previous month came from gig activities. This compares with 12% of gig workers ages 25 to 64.