by Jodie T. Allen, Shawn Neidorf and Nilanthi Samaranayake

If economists and real estate experts are correct in saying that the U.S. housing market is not only in a slump but likely to remain there for some time to come, that will come as a surprise to a (62%) majority of Americans who expect home prices to continue the upward trend of recent years. But the public may be equally surprised if the overall economy continues to show the resilience in the face of high energy prices and real estate weakness that is currently evoking enthusiasm among many economists and Wall Street watchers.1

On the housing front, despite extensive news coverage of weakness in the housing market, a substantial majority of Americans in a June survey, conducted by the Pew Research Center for the People and the Press, not only say that home prices have risen over the last few years, but also that they expect that climb to continue. On the other hand, nearly two-in-three among the public rate the current economy as “only fair” (40%) or “poor” (25%) compared with 33% who rate it “good” or “excellent.” And looking ahead a year, a scant 16% expect that economic conditions in the country as a whole will be better, while a quarter (24%) expect them to worsen and more than half (55%) expect they will stay about the same.

High Hopes for Housing…

Not surprisingly, most Americans are aware that the U.S. housing market boomed in the early years of this century. More than seven-in-ten among the public (72%) say home prices have gone up in their areas in recent years — four times as many as those who say that prices have dropped. In that they are correct — at least until very recently.

While the residential housing bubble of the first half of the decade began to deflate in mid-2005, median sales prices did not actually decline until early this year and recovered somewhat in the spring. (See trend data in endnote.)2 However, as Federal Reserve Chairman Ben Bernanke recently noted, since their 2005 peak, sales of existing homes have declined more than 10%, and sales of new homes have fallen by 30%.3

Assessments of the last few years’ housing market vary little by demographic characteristics such as race, age and education, although women are somewhat more likely than men to say prices have gone up a lot (52% vs. 46%). Where people live does, however, make a big difference in their perceptions of the real estate market.

Those living in the Western United States are almost twice as likely as Midwesterners to say prices have gone up a lot in recent years in their areas (63% vs. 33%). Northeasterners (50%) and Southerners (53%) are also more likely to note prices going up a lot than are Midwesterners. Urbanites are more likely than rural residents to say prices have risen a great deal (54% vs. 42%), while suburbanites fall in between (50%). Again, these perceptions are generally in accord with actual experience. While housing prices rose nationally at a 9% annual rate in the first half of the decade, they more than doubled in many areas near the East and West Coasts.4

That pattern has continued in recent years. Nationwide, median prices increased 14% between 2004 and 2006, but that varied regionally from a low of 8% in the South to a high of 20% in the West with median prices in the Northeast (12%) and Midwest (9%) in between.

Where Americans depart most sharply from the expert consensus is in their expectations for the future. Recently the National Association of Realtors again lowered its U.S. housing market forecast for this year, projecting that existing home sales will fall 4.6% to 6.18 million, compared with its previous forecast of a 2.9% decline. The NAR foresees an even sharper drop of 18.2% in new home sales.5

Nonetheless, most Americans expect that the good times will continue for homeowners and sellers. Looking ahead, more than six-in-ten people (62%) say they expect their local real estate prices to rise over the next few years, more than double the proportion who expect prices to fall (28%).

Overall, those who say housing prices have gone up either a lot or a little in recent years are most likely to say prices will go up in coming years; indeed, more than two-thirds say so. Only 26% of people who say prices have risen in recent years expect them to fall in the near future. Those who say prices have gone down in their areas over the last few years are more evenly split in predicting the future: 48% say prices will go up, while 42% say they’ll go down.

The extent to which rising home prices are a positive or negative expectation depends, of course, on whether one is currently a homeowner or a prospective first-time buyer. Even homeowners who have no current intention of selling may realize immediate returns from rising prices by refinancing their mortgages. The downside of this phenomenon is that many of those who, in expectation of a continuing run-up in home values, have done so in recent years may now be especially vulnerable to a housing downturn — especially if they are holders of adjustable-rate subprime mortgages with low or zero initial rates that can rise sharply over time (ARMs). According to a new report from the Mortgage Bankers Association, the number of foreclosures on home mortgage loans hit a new high in the first quarter of 2007, topping the record set in the last quarter of 2006. The rate of serious delinquencies is especially high among subprime ARMs, reaching 15.75% in the last quarter.6

Whether in hope or fear, some demographic group differences in home price predictions are notable. Those with more education, are much less likely to anticipate large price jumps than are those with less education. Similarly, persons in families with modest incomes are significantly more likely to expect substantial future increases in home prices than are those with higher incomes. However, across all income ranges, the predominant prediction is for at least a small rise in home prices.

Blacks are much more likely than whites to think house prices will increase a lot (40% vs. 23%), and women are somewhat more likely than men to expect a substantial rise (28% vs. 22%). Young people also are much more likely to predict steep price hikes than their elders: 37% of those ages 18 to 29 project much higher prices in their areas, while only 19% of those 65 and older agree.

But Little Enthusiasm about the Overall Economy…

Cheerful outlooks about either the current or near-term future of the nation’s economy are, however, in relatively short supply. Overall, by a two-to-one margin, Americans rate economic conditions as fair or poor rather than excellent or good. The portion of the public giving the economy the thumbs up is down slightly from the 38% who did so in December 2006, but is in line with readings on this question over the last few years.

Only among Republicans does a majority (56%) call conditions good or excellent although those in higher income categories generally ($75,000 and above) split about evenly on the subject.

A less pronounced partisan division is seen in expectations about the course of the economy over the next year. Despite cautious optimism among economists and financial analysts, few among the public (16% overall) expect economic conditions to be better a year from now. No difference in that view emerges across party lines.

Republicans, however, are significantly less likely to predict a worsening of the economy — 16% of Republicans do so compared with 30% of Democrats and 24% of independents.

No such party line difference in economic outlook was observed in a Pew survey conducted seven years ago in June 2000, although attitudes about the economy’s path were virtually identical then to those currently prevailing. In general, Pew surveys find that the partisan gap in opinions about the economy has increased substantially in recent years.

Some partisan differences are also seen in people’s choice of the biggest economic problem facing the country. Gas prices top the list of concerns across the political spectrum, but Republicans are considerably more likely than either Democrats or independents to rank them as the biggest of the nation’s economic problems (39% of Republicans do so, compared with 23% of Democrats and 27% of independents.)

That difference may be less an indication of the relative severity of pump shock as experienced by Republicans, than of their more modest concern about other problems, most notably a top worry cited by a substantial number of Democrats — the gap between rich and poor. More than twice as many Democrats as Republicans (18% vs. 7%) rank a widening wealth and income gap as America’s top economic problem.

However, Republicans are no less likely than Democrats to point to health care costs as a primary national problem. Moreover, few in either party or among the unaffiliated single out the job market as a major challenge.

Though Less Pessimism about the Job Market

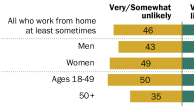

Overall about half of the public (49%) calls job finding difficult in their community at the present time and that proportion rises to 55% when the qualifier “good job” is added to the question. Still, the trend in the public’s views about the state of the job market differs significantly from the continuing pessimism expressed about the overall state of the economy.

Pew polls taken over the last two years show the number of Americans saying jobs are hard to find registering as high as 60% in May 2005 and remaining at 56% through much of 2006. In December 2006, however, that number fell to 49%, where it remains in the most recent poll. Moreover, the percentage saying that good jobs are difficult to find declined from 64% in January 2006, when the question was first asked in a Pew survey, to 55% in the most recent poll.

Among Republicans, only 35% say that a job is hard to find while about the same percentage (38%) say that about a “good job.” Among Democrats, however, more than six in ten see job finding as difficult, with no significant distinction being made between finding jobs generally (61% rate finding them difficult) or finding good jobs (63%). Only for independents does the differentiation between all jobs and good jobs make a significant difference, with 44% of independents saying jobs generally are hard to find but 63% saying that about good jobs.

Job market assessments differ little across age groups, but those with lesser degrees of education tend to see the job market as more problematic. About six in ten among adults with high school degrees or less education rate it hard to find any job or a good job in their community. Finding jobs, especially good jobs, is seen as most difficult in rural areas where 62% rate it difficult to find any job and fully three in four (74%) say good jobs are hard to come by.

Notes

1See, for example, “Economists See Housing Slump Enduring Longer,” The Wall Street Journal, June 9, 2007; Page A1; and “Economists React: ‘Amazing Resilience’,” The Wall Street Journal Online, June 13, 2007.

2Recent years saw housing prices rise from a median sales price of $165,000 in 2002 to $221,900 in 2006, according to the National Association of Realtors. Early 2007, however, saw a drop. In January, the median sales price for homes in the United States (including condominiums) was $210,900, off $11,000 from the 2006 median. By April, the monthly median had climbed to $220,900. (Figures are not adjusted for inflation.) Walter Molony, a spokesman for NAR, noted that sales in early 2007 have been stronger in lower-priced regions (e.g. Texas) and slower in higher-priced regions (e.g. California, Florida), thereby dragging down the median figure.

3“The Housing Market and Subprime Lending,” remarks by Federal Reserve Chairman Ben S. Bernanke to the 2007 International Monetary Conference, Cape Town, South Africa, June 5, 2007.

4Bernanke, Ibid, and The Wall Street Journal, June 9, 2007.

5“Realtors Cut 2007 Forecast Again,” The Wall Street Journal Online, June 6, 2007 http://online.wsj.com/article/SB118113900949926451.html

6“Foreclosure Rate Hits Historic High,” The Washington Post, June 15, 2007, p. D01, and “Home Foreclosures Hit Fresh High,” The Wall Street Journal, June 15, 2007, p A3.