Americans owe about $1.6 trillion in student loans as of June 2024 – 42% more than what they owed a decade earlier. The increase has come as greater shares of young U.S. adults go to college and as the cost of higher education increases.

Here are five facts about student loans in America based on a Pew Research Center analysis of data from several sources, including the Federal Reserve Board’s 2023 Survey of Household Economics and Decisionmaking.

Pew Research Center conducted this analysis to understand how many Americans have outstanding student loan debt and how this debt is associated with their economic well-being.

In this analysis, adults with student loan debt include those whose student loans are temporarily on hold or in forbearance. The analysis does not include debt incurred through credit cards or other types of loans used for education.

The analysis is mostly based on the Federal Reserve’s 2023 Survey of Household and Economic Decisionmaking (SHED). Conducted annually since 2013, the SHED measures U.S. adults overall financial well-being and difficulties meeting expenses. It also regularly includes a battery of questions on debts incurred for education, education decisions, and an assessment of the value of higher education. The 2023 SHED had 11,400 respondents, weighted to be representative of the U.S. adult civilian noninstitutionalized population.

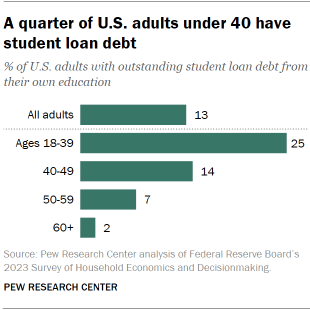

One-in-four U.S. adults under 40 have student loan debt. This share drops to 14% among those ages 40 to 49 and to just 4% among those 50 and older.

Of course, not all Americans attend or graduate from college, so student loan debt is more common among the subset of people who have done so. Among adults under 40 who have at least a four-year college degree, for example, 36% have outstanding student loan debt.

Age differences reflect, in part, the fact that older adults have had more time to repay their loans. Still, other research has found that young adults are also more likely now than in the past to take out loans to pay for their education. In the 2018-2019 academic year, 28% of undergraduate students took out federal student loans. That’s up from 23% in 2001-2002, according to data from College Board – a nonprofit organization perhaps best known for its standardized admissions tests (like the SAT) that also documents trends in higher education.

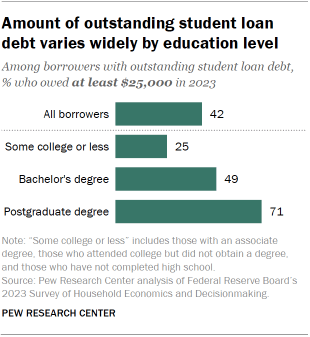

The amount of student loan debt that Americans owe varies widely by their education level. Overall, the median borrower with outstanding student debt owed between $20,000 and $24,999 in 2023.

- Among borrowers who attended some college but don’t have a bachelor’s degree, the median owed was between $10,000 and $14,999 in 2023.

- The typical bachelor’s degree holder who borrowed owed between $20,000 and $24,999.

- Among borrowers with a postgraduate degree the median owed was between $40,000 and $49,999.

Looking at the same data another way, a quarter of borrowers without a bachelor’s degree owed at least $25,000 in 2023. About half of borrowers with a bachelor’s degree (49%) and an even higher share of those with a postgraduate education (71%) owed at least that much.

Adults with a postgraduate degree are especially likely to have a large amount of student loan debt. About a quarter of these advanced degree holders who borrowed (26%) owed $100,000 or more in 2023, compared with 9% of all borrowers. Overall, only 1% of all U.S. adults owed at least $100,000.

Young college graduates with student loans are more likely than those without this kind of debt to say they struggle financially. A quarter of college graduates ages 25 to 39 with loans say they are either finding it difficult to get by financially or are just getting by, compared with 9% of those without loans. And while only 29% of young college graduates with outstanding student loans say they are living comfortably, 53% of those without loans say the same.

Young college graduates with student loans still tend to have higher household incomes than their counterparts who haven’t completed college. For many young adults, student loans are a way to make an otherwise unattainable education a reality. Although these students have to borrow money to attend college, the investment might make sense if it leads to higher earnings later in life.

College graduates ages 25 to 39 who have student loan debt have higher household incomes than non-college graduates in the same age group (regardless of student loan status). But their household incomes are lower than those of young college graduates who don’t have student loan debt.

Around half of young college graduates with student loans (48%) have household incomes of at least $100,000. That compares with just 14% of non-college graduates. But among college graduates without student loan debt, 64% have household incomes of $100,000 or more.

Household income includes an individual’s income and the income of any spouse or partner living with them. So these differences may at least partly reflect the fact that college graduates are more likely to be married.

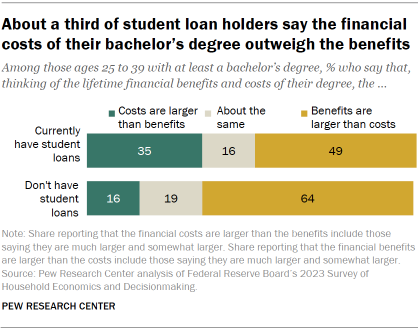

Young college graduates with student loan debt are more likely than those without debt to say their education wasn’t worth the cost. About a third (35%) of those ages 25 to 39 who have at least a bachelor’s degree and outstanding student loan debt say the benefits of their degree weren’t worth the lifetime financial costs. By comparison, 16% of young college graduates without outstanding student loans say the same.

Note: This is an update of a post originally published Aug. 13, 2019.