Risky Business

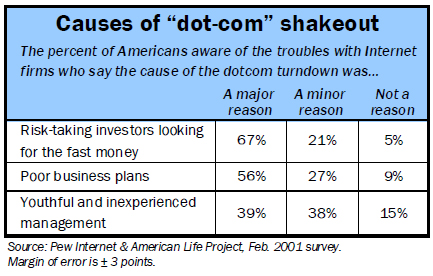

In the midst of dropping share prices, layoffs, and closings among Internet companies, most Americans attribute dot-com difficulties to overeager investors looking for quick payoffs and to the poor business plans of dot-com entrepreneurs. According to a Pew Internet & American Life Project poll conducted in February, 67% of the Americans who have heard about dot-coms’ financial troubles subscribe to an “irrational exuberance” view of the cause of dot-coms’ troubles, namely that Internet companies are struggling because investors’ desire to turn quick profits led to too many business risks. A solid majority (56%) of those who have heard about Internet firms’ problems say that Internet companies lacked clear plans for attaining profitability and that this is a major reason behind their recent financial problems. Some 39% blame the youth and inexperience of some of the Internet firms’ executives.

With dot-com layoffs totaling nearly 35,000 workers since December and 66,000 in the past 15 months, most Americans (67%) are aware of the reversal of fortune among Internet companies. About 57 million Americans, or 30% of all American adults, have followed these developments very closely, with 43% of Internet users deeply engaged with stories of dot-com woes.

Although many people are following dot-com developments, Americans seem cool-headed about the shakeout’s overall impact on the economy and the Internet itself. Only one-quarter (26%) of Americans who have heard about online business troubles think that the dot-com slowdown will have a major impact on the economy.

As for Internet content, about three-fifths (57%) of the Americans who have heard about dot-com troubles agree with the proposition that closing down some Web sites is a good thing because the Internet had too many sites with too little to offer. This is twice the number (28%) who believe that the loss of these Web sites is bad because it would lessen the amount of choice available on the Web.

Nonetheless, approximately 31 million Americans say they have been affected directly or indirectly by the dot-com downturn. Some 9% of Americans say they know someone who is victim of a dot-com layoff; 7% of Americans say their family has lost money in a dot-com investment; and 8% of Internet users say one of their favorite Web sites has vanished because of the financial trouble at Internet firms.

The Internet Elite are Most Likely to be “Dot-Glums”

Not surprisingly, the Internet elite—the 20% of the most highly wired Internet users who have been on the ’Net the longest and who log on daily—have felt the dot-com tumble the most. A sizable minority of this elite, call them the “dot-glums,” have lost money on a dot-com investment, know someone who has been laid off from an Internet company, or have seen a Website they like shut down. In fact, the dot-glums make up 38% of the Internet’s elite users, or about 8 million Americans. Nearly one-quarter (24%) of dot-glums know someone who has lost a job at an Internet company, 14% either lost money on an Internet investment or have a family member who did, and 15% are missing a Web site that no longer exists.

Who are the dot-glums? They are mostly male (69%), well-off (26% have household incomes over $100,000 compared with 7% of the overall population), and well educated (51% have college degrees). And if this group is commiserating over the Internet with fellow travelers who have suffered from the dot-com downturn, they are doing so at high speed. Fully one-third (33%) of the dot-glums have broadband Internet connections at home compared with 12% of all Internet users.

Different Generational Perspectives

The popular perception is that the young are leading the Internet revolution, so it is no shock that young people see the sagging fortunes of Internet companies differently from their elders. In general, Americans do not see the inexperience of Internet entrepreneurs as a principal reason for the current downturn. When asked whether the youth and inexperience of the management of Internet companies is a major reason for their financial problems, 39% of all Americans agree with that, but an equal number (38%) say it is a minor reason. However, older Americans are much more likely than young Americans to blame young entrepreneurs for dot-com troubles. Fully 44% of those over age 50 say the youth of these companies’ leaders is a major problem, compared to 34% of those between ages 18-29 who say so.

The difference is more striking in those who thought inexperience is a minor factor. Nearly half (46%) of those between ages 18 and 29 say youth and inexperience are minor factors in the financial problems of Internet companies, while only about one-quarter (26%) of those over age 50 agree it is a minor problem.

A similar generational division exists when people are asked whether Internet investors took too many risks in their eagerness to make money. Most Americans (67%) agree that this is a major reason behind dot-coms financial woes. But Americans between age 18 and 29 are less likely to blame greed than their elders are. Fully 78% of those between 50 and 64 say investors’ risky behavior is a major cause of the downturn, while 58% of Americans between 18 and 29 feel this way.

Some 21% of Americans think investors’ risky behavior is only a minor factor in dot-coms’ fading fortunes. Young Americans are much more likely to say this than older Americans. One-third (34%) of those in the 18-29 age group say investors’ risky behavior has been a minor problem for dot-coms, while only 11% those between ages 50 and 64 are willing to downplay that issue and call it a minor factor.

The generational divide extends to people’s perceptions about the business plans of dot-coms, although it is less pronounced. About half (49%) of Americans between 18 and 29 agree that ill-conceived business plans have been a major reason for dot-coms’ decline, compared to about 61% of Americans between 50 and 64 who cite poor business plans as a major problem for the dot-coms. As with perceptions about risk, young people feel more strongly than their elders that poor business plans have not been a major factor behind dot-coms’ decline. Two out of five (39%) of Americans between 18 and 29 say poor business plans have been a minor factor in dot-com financial problems; this is twice the number of older Americans (19% between 50 and 64) who see poor business plans as minor factors.

Education, Income, Internet Use Drive Perceptions about Economic Impact—Except for the Dot-Glums

Americans with higher incomes and higher levels of educational attainment are less likely to see dire economic consequences from the dot-com decline than Americans at lower income and education levels. Three in five Americans (61%) think the slowdown among Internet firms will have a minor impact on the economy, and only a quarter (26%) believe its impact will be major. Only a fifth (20%) of people whose annual household incomes exceed $75,000 think the impact will be major. That compares with the more than one-third (36%) of those in households whose incomes fall below $30,000 who think the impact will be major. On the other side of the coin, 51% of American households making less than $30,000 think the impact will be minor, compared to 68% of households that make more than $75,000 who say so.

In broader terms, Internet users have a more sanguine view of the likely economic impacts of the dot-com slowdown than non-users. Twenty-three percent of Internet users believe that the slowdown in dot-coms will have a major impact on the economy, compared to 32% of non-Internet users. Conversely, 67% of Internet users think the impact will be minor compared with half (51%) of non-users.

When the pain hits close to home, however, perceptions about larger economic consequences change. The dot-glums—the educated, wealthy, and experienced elite of the Internet who are more likely to have first-hand experience with the dot-com downside—are about as likely as those living in $30,000 households to think the Internet shakeout will have a major impact on the economy. Fully one-third (34%) of the dot-glums believe the Internet downturn will have a major impact on the economy.

Gender

Men and women have somewhat different views on the causes, impacts, and likely consequences of the financial difficulties of the Internet industry. The starkest contrast is in attention paid to dot-com financial news. By a 38% to 23% margin, men are far more likely than women to be following the travails of dot-coms very closely; among Internet users, the numbers are 51% for men and 34% for women.

In thinking about the causes of the shakeout, men are more likely than women, by a 70% to 64% margin, to believe risk-taking among Internet investors has contributed to the dot-com slump. Likewise and by the same margin (59% to 53%), men are more likely to believe weak business plans have played a role in the downturn. As for youthfulness of dot-commers being a problem, men are more likely to say this played a major role in firms’ problems (by 42% to 36%).