The public’s views of current economic conditions remain largely negative. And an increasing percentage thinks that the economy will be worse a year from now than it is today.

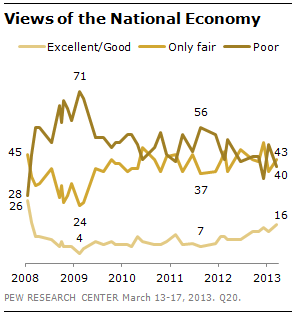

Overall, 43% rate current economic conditions in this country today as only fair, while nearly as many (40%) say they are poor. Very few describe economic conditions as excellent or good (16%).

Opinions about the national economy vary only modestly by family income: No more than about one-in-five in any income category rates the economy positively. There continue be partisan differences in views of economic conditions – Republicans (53%) and independents (42%) are more likely than Democrats (27%) to rate current economic conditions as poor.

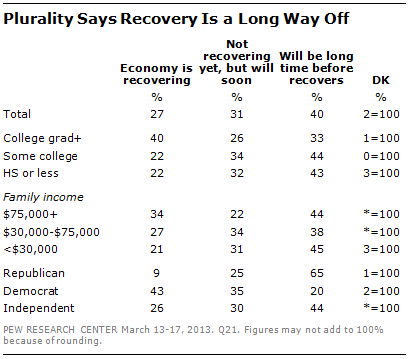

Consistent with the negative economic ratings, only 27% say the economy is currently recovering. About three-in-ten (31%) say the economy is not yet recovering but will recover soon. A 40% plurality says it will be a long time before the economy recovers. These opinions have changed little since last October.

College graduates are more likely than those with lower levels of education to say the economy is currently recovering. Four-in-ten (40%) college graduates say the economy is recovering, compared with just 22% of those without a college degree.

Democrats mostly say the recovery is already underway (43%) or will occur soon (35%); just 20% say it will be a long time before the economy recovers. Nearly two-thirds of Republicans (65%) say it will be a long time before the economy recovers.

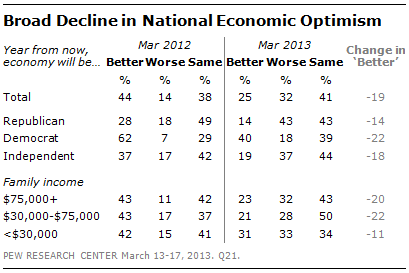

For the first time in Obama’s presidency, more say they expect economic conditions to be worse a year from now (32%) than better (25%); 41% expect conditions to be about the same as now. In January, opinion was flipped, with somewhat more expecting the economy to be better in a year (33%) than worse (25%). Last March, 44% expected that economic conditions would be better in a year, while just 14% said they would be worse.

A year ago, about four-in-ten in all family income groups said they expected the economy to improve over the next year. Today, just 23% of those with incomes of $75,000 or more expect economic conditions to be better a year from now, as do 21% of those with incomes of between $30,000 and $75,000 and 31% of those with family incomes of less than $30,000.

As in recent years, Democrats have a more positive economic outlook than do independents or Republicans. But among all three groups, economic optimism has declined since last year. Currently, 40% of Democrats say they expect economic conditions to be better a year from now; 62% expressed that view last March. Among independents and Republicans, economic optimism also has declined since last March (by 18 points and 14 points, respectively).

Prices Surge as Top Economic Worry

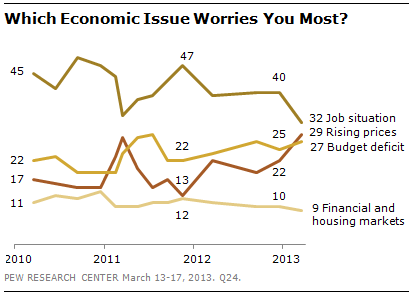

In the current survey, 32% say the job situation is the national economic issue that most worries them. But nearly as

many (29%) cite rising prices, while 27% say that the federal budget deficit is their biggest economic worry. Just 9% say problems in the housing and financial markets are their top economic worry.

In December, 40% said jobs were the issue that most worried them, while 25% said the budget deficit and just 22% named rising prices; 10% said problems in the markets.

Rising prices are of particular concern to those with lower family incomes. For example, 33% of those earning less than $30,000 a year cite rising prices as their top economic worry, about the same percentage as cites the job situation (34%). By contrast, those with family incomes over $75,000 express more concern over the federal budget deficit (42%) and the job situation (27%) than over rising prices (19%).

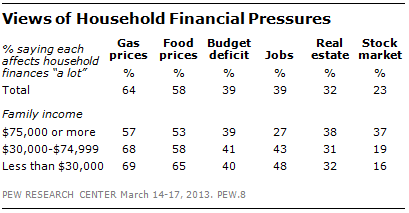

Gas, Food Prices Seen as Having Biggest Impact on Finances

Nearly two-thirds (64%) say gas prices affect their household’s financial situation a lot, and 58% say prices for food and consumer goods affect them a lot. About four-in-ten say the federal budget deficit (39%) and the job situation (39%) affect their household finances a lot. Just 32% say real estate values in their area affect them a lot and even fewer (23%) say how

the stock market is doing affects their household financial situation a lot. Views of household financial pressures are little changed from when the question was last asked in April 2011.

Gas prices are an especially pressing concern for those with family incomes below $75,000 a year. Nearly seven-in-ten (68%) of those earning less than $75,000 a year say gas prices affect their household’s financial situation a lot, compared with 57% of those earning $75,000 or more. People with incomes of less than $75,000 also are more likely than those with higher incomes to say that their household finances are affected a lot by the availability of jobs in their area.

The performance of the stock market has much more of an impact on those earning $75,000 or more (37% say this affects their household a lot) than on those earning $30,000-$74,999 (19% a lot) and those earning under $30,000 (16% a lot). Still, even for those with higher incomes, more say gas and food prices impact their finances than the stock market.

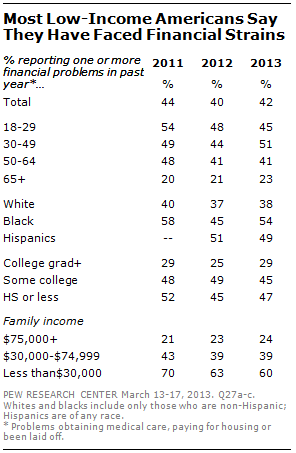

Many Still Facing Financial Stress

More than four years after the start of the recession, most Americans with low family incomes are experiencing financial problems. Overall, 42% of the public say they have faced one or more of the following in the past year: difficulty obtaining or paying for medical care; problems paying their rent or mortgage; or losing a job.

Among those with family incomes of less than $30,000 a year, 60% have faced one or more of these problems in the past year. By comparison, only about a quarter (24%) of those with incomes of $75,000 or more report encountering at least one of these problems.

Blacks continue to be much more likely than whites to face these financial problems. About half of blacks (54%) say they have either had problems getting or paying for medical care, trouble affording their rent or mortgage or been laid off. By comparison, 38% of whites have faced one or more of these problems.

When it comes to overall assessments of their personal finances, impressions have changed little in recent years. Nearly four-in-ten (38%) say their finances are in excellent or good shape, while 41% say their finances are only fair and 21% say their finances are poor. While a majority (63%) of those with family incomes of at least $75,000 rate their finances positively, just 19% of those with incomes below $30,000 do the same.

Despite the gloomy outlook for the national economy, most people (60%) continue to say that their own finances will improve at least some over the course of the next year. While views of personal finances vary little across age groups, financial optimism continues to be more widespread among younger people: 77% of those younger than 30 expect their finances to improve, as do 70% of those 30 to 49; fewer than half (44%) of those 50 and older expect their finances to improve.

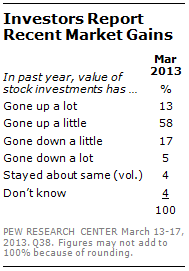

Investors See Market Gains, Remain Bullish

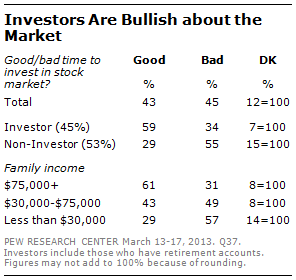

Americans who have money in the stock market (45% of the public) say they have reaped benefits from the market’s gains. Most of those with money invested in the market say their investments have gone up a little (58%) or a lot (13%) over the past year. Just 22% of investors say their portfolio has lost value over the past year.

Most investors say it is still a good time to invest in the market. Overall, the public is divided – 43% see this as a good time to invest while 45% say it is a bad time. Among investors, who are largely those with higher incomes, 59% see this as a good time to invest in the stock market while 34% say it is bad time. Among those with no money in the market, a majority (55%) says this is a bad time to invest in the market.

Lower-income Americans are generally unable to set aside savings for the future, whether they invest that money in the market or not. Overall, just 41% of Americans say they have been able to save money for the future while 58% say they have not. There are wide socio-economic divides in the percentages saying they have saved for the future: 63% of those with family incomes of $75,000 or more say they have saved for the future, compared with 24% of those with incomes below $30,000.

A related Pew Research Center report, published last October, found that Americans are more worried about their retirement finances today than they were at the end of the recession in 2009. (See “More Americans Worry about Financing Retirement,” Oct. 22, 2012.)

On the Job, Some Say the Workload is Rising

The percentage of Americans who say they have gotten a better job, or received a raise at their current job, has remained steady in recent years. About three-in-ten people (28%) –

including 44% of those working full or part-time – say they have gotten a better job or gotten a raise in the past year.

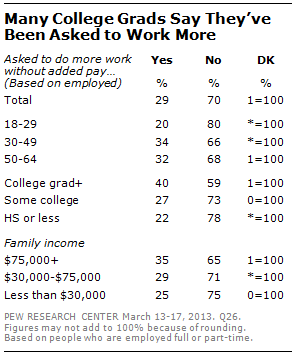

Some working people, especially those with more education, say that in the past year they have been asked to do more work or work additional hours without more pay. Overall, 29% of working people say they have been asked to do more work without additional pay in the past year. Among college graduates, including those with post-graduate degrees, 40% report being asked to work extra hours or do more work without more pay. That compares with 22% of those with no more than a high school education.