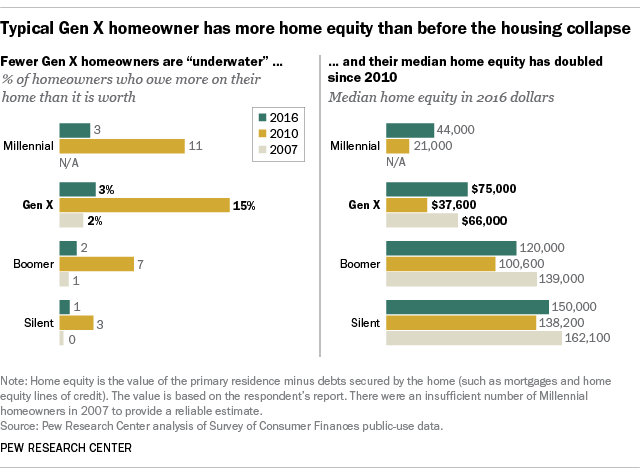

Few American homeowners were spared from the broad housing collapse a decade ago, but Generation Xers were hit particularly hard. Newer to the housing market, more likely to be buying at peak prices and taking on more mortgage debt to buy their homes, they lost more wealth than other generations. But a new Pew Research Center analysis of Federal Reserve data finds that Gen Xers are the only generation of households to recover the wealth they lost during the Great Recession.

Wealth tends to rise most rapidly at younger ages before peaking once people reach their early 70s. The more robust wealth recovery of Gen Xers compared with the older Boomer and Silent generations fits this pattern. Wealth, or net worth – the difference between the value of a household’s assets and debts – is an important dimension of household well-being because it is a measure of a family’s “nest egg,” resources that can sustain members through job layoffs or emergencies as well as provide income during retirement.

For many American households the bulk of their wealth is in their home, and this was especially the case for households headed by Gen Xers (then ages 27 to 42) in 2007. About half of the assets they owned were in the value of their primary residence, whereas households headed by a member of the Baby Boom or Silent generation had a higher share of their money in financial assets such as checking or retirement accounts.

Gen X’s economic hard times

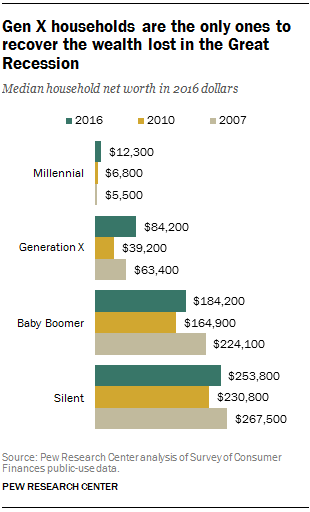

The median net worth of Gen X households had declined 38% from 2007 ($63,400) to 2010 ($39,200), while the typical wealth loss for Boomer and Silent households was not as steep (26% and 14%, respectively). Millennials, who were beginning to form households and accumulate wealth (the oldest was only 26 in 2007), were hit hard by the Great Recession in terms of employment and earnings, but not in terms of wealth destruction, as they had little wealth to lose. (The Great Recession began in December 2007 and ended in June 2009. )

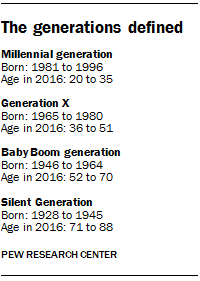

During the downturn, Gen X homeowners experienced the largest decline in home equity, the difference between what the primary residence is worth and all the debts secured by the home. The median home equity of Gen X homeowners fell 43% from 2007 ($66,000) to 2010 ($37,600). Boomer and Silent homeowners had smaller declines in median home equity (28% and 15%, respectively).

Stock prices also plunged after 2007, and most households (Millennials being the exception) had declines in financial holdings. The median value of the financial assets owned by Gen X households fell 20% from 2007 to 2010. Typical Boomer and Silent households had modestly larger declines in their financial assets.

Bouncing back

But while the economic downturn had a disproportionately negative impact on Gen Xers, their fortunes have rebounded more than those of other generations during the post-recession economic expansion and as home and stock prices have risen. Since 2010, the median net worth of Gen X households has risen 115%. In fact, in 2016, the most recent year with available data, the net worth of a typical Gen X household had surpassed what it was in 2007 ($84,200 vs. $63,400). As of 2016, the median wealth of households headed by Boomers and the Silent Generation remains below 2007 levels, though their household wealth still exceeds that of Gen X.

The full wealth recovery of households headed by Gen Xers stems from several factors.

First, they are the only generation to have recovered the home equity they lost in the downturn. The typical home equity level of Gen X homeowners has doubled since 2010, though this was not achieved without considerable borrower distress. According to Federal Reserve data, 15% of Gen X’s homeowners were “underwater” on their homes in 2010 (meaning they owed more than they owned). By 2016 only 3% were underwater. This improvement is due to lenders foreclosing on homeowners as well as appreciating home values and mortgage modifications. Still, reducing the ranks of homeowners with negative equity in their homes boosts wealth.

Gen X households also experienced a stronger recovery in financial assets than Boomer and Silent households. The median financial assets of Gen X households nearly doubled from 2010 ($11,300) to 2016 ($21,600). In comparison, Boomer and Silent households’ financial assets are at a level similar to before the Great Recession.

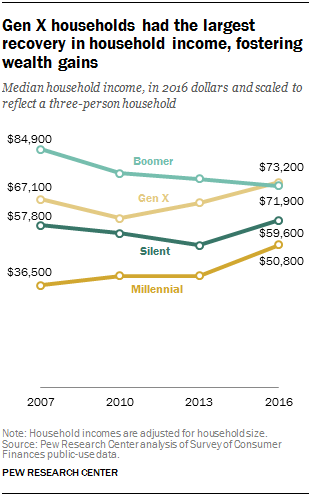

In addition, unlike their older counterparts, Gen Xers are still of prime working age. Higher household income tends to boost wealth because it enables families to save and add to wealth. Gen X’s ability to rebuild its wealth may reflect its relatively robust household income growth since 2010. The median adjusted household income of Gen X households increased more than 20% and, at $73,200 in 2016, surpassed that of other generations. The oldest Gen Xer was 51 as of 2016, meaning that Gen X workers are still approaching their peak earning years. The number of Gen Xers in the labor force has remained stable since 2008, whereas the Boomer and Silent labor force has shrunk through retirements and deaths.

Through first-hand experience Gen Xers learned the painful consequences of economic contractions. At least in terms of wealth, they are now better positioned to weather the next one.