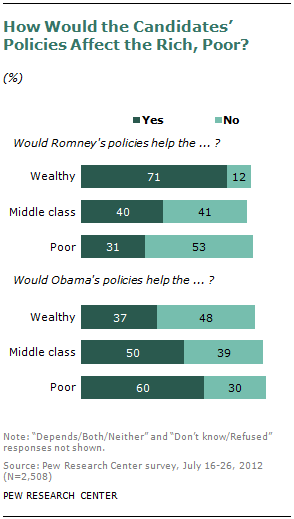

When the national conversation focuses on class, the social safety net and the distribution of wealth as it has in the past week, the public sees clear differences between Barack Obama and Mitt Romney, and Obama has an overall advantage. People are more likely to say Obama’s policies would help the middle class and poor, while Romney’s policies are generally seen as helping the rich.

Yet there are aspects of both candidates’ arguments on these issues that resonate with the public. Majorities believe that many poor people are too dependent on government assistance, and that the government can’t afford to do more for the poor than it is already doing. But most also hold that the government has a responsibility to care for those in need and that upper-income—not lower-income— people are not paying their fair share in taxes.

In a July 2012 Pew Research survey, 71% of adults nationwide said if Romney were elected president, his policies would likely benefit wealthy people. Four-in-ten said Romney’s policies would help middle class people, and only 31% said Romney’s policies would help the poor.

By contrast, a majority of the public (60%) predicted that if Obama were elected to a second term his policies would help the poor. Half of all adults said Obama’s policies would help the middle class, and 37% said his policies would help wealthy people.

The public expresses similar views when asked about the two major political parties. More than six-in-ten (63%) say the Republican Party favors the rich over the middle and lower classes. About one-in-four (23%) say the GOP favors the middle class, and a mere 3% say the GOP favors the poor.

When it comes to the Democrats, the public doesn’t see the party as clearly favoring one class over another. Some 20% say the Democrats favor the rich, 35% say the Democrats favor the middle class, and 32% say they favor the poor. The views of both parties are largely unchanged from 2008.

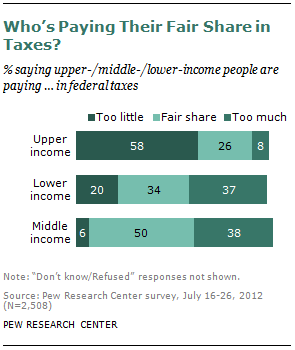

The Tax Burden—Who Pays Too Little?

Americans have mixed views on whether the poor and the middle class pay their fair share in taxes, but they are more united in their views of the rich. In the July Pew Research survey, 58% of all adults said upper-income Americans pay too little in federal taxes. Another 26% said upper income adults pay their fair share in taxes, and 8% said they pay too much.

The public is divided over whether lower-income people pay the appropriate amount in federal taxes. Some 37% say lower-income people pay too much in taxes, while roughly as many (34%) say lower-income people pay their fair share in taxes. One-in-five adults say lower-income people pay too little in taxes. This view is much more widely held among Republicans than among Democrats or independents: 30% of Republicans, compared with 9% of Democrats and 23% of independents, say the poor pay too little in taxes.

When it comes to the middle-class tax burden, there is no clear consensus among the public. Half of all adults say middle-income people pay their fair share in federal taxes. About four-in-ten (38%) say middle-income people pay too much in taxes, and 6% say they pay too little.

For a more detailed discussion of these topics, see “Yes, the Rich Are Different,” August 27, 2012.

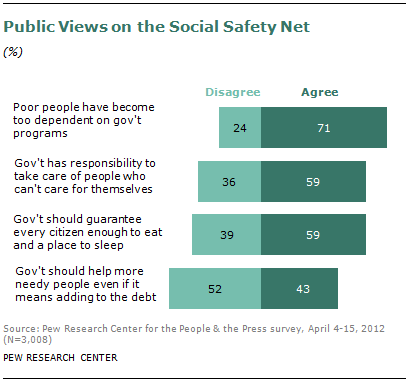

Views on the Social Safety Net

The public remains ambivalent about the role that government should play in helping the poor. According to a Pew Research Center survey conducted in April, 2012, a strong majority of Americans (71%) agree that poor people have become too dependent on government assistance programs. Some 24% disagree with this notion. The share agreeing that the poor are too dependent on government programs was even higher in the mid-1990s. In the summer of 1994, when Republicans in Congress led the charge against what they said was an overreaching federal government, 85% of the public agreed that poor people were too dependent on the government.

Yet most Americans believe the government should provide all citizens with the basic necessities of life. In the April 2012 survey, 59% of adults agreed that the government should guarantee every citizen enough to eat and a place to sleep. Roughly four-in-ten (39%) disagreed with this statement. Similarly, the same poll found that 59% agreed it is the responsibility of the government to take care of people who can’t take care of themselves, while 36% disagreed with this.

When the public is asked to consider the fiscal implications of government assistance to the poor, support for additional spending is more muted. A minority of adults (43%) agree that the government should help more needy people even if it means going deeper in debt, while roughly half (52%) reject this idea. Since the start of the Great Recession, the balance of opinion on this question has shifted somewhat. In January 2007—before the recession began—the public was more likely to agree than disagree that the government should help more needy people even if it meant going deeper into debt (by a margin of 54% to 40%).

Views on government assistance to the poor vary dramatically by party identification. In fact, Republicans and Democrats are more divided in their views on the social safety net than they are on a host of other issues ranging from public policy to personal religiosity. There are partisan differences of 35 points or more in opinions about the government’s responsibility to care for the poor, whether the government should help more needy people if it means adding to the debt and whether the government should guarantee all citizens enough to eat and a place to sleep. On all three measures, the percentage of Republicans asserting a government responsibility to aid the poor has fallen in recent years to 25-year lows.

For a more detailed discussion of these topics, see “Partisan Polarization Surges in Bush, Obama Years,” June 4, 2012