The analysis is based on the National Postsecondary Student Aid Study (NPSAS). NPSAS is collected every 3 to 4 years by the U.S. Department of Education’s National Center for Education Statistics. NPSAS is specifically designed to measure how undergraduates and their families pay for postsecondary education. It is nationally representative of undergraduate borrowers and non-borrowers in postsecondary institutions eligible to participate in Title IV of the Higher Education Act aid programs.

The most recent NPSAS was collected in 2012 and is representative of all undergraduates enrolled at any time between July 1, 2011, and June 30, 2012. NPSAS collects information on students from several sources. One strength of the collection is that information on student loans is obtained, in part, from student financial aid records provided by the college or university. Federal loan indebtedness comes from the financial aid records, whereas private loan indebtedness is student reported. Some colleges and universities do not collect private loan data from students, so colleges and universities cannot verify the student’s report in all cases (Steele and Baum, 2009). So the amounts of total indebtedness should be considered estimates.

This report focuses on undergraduates who are in the graduating bachelor’s degree class of the NPSAS administration. So, for example, for the 2012 NPSAS the analysis is restricted to the class of 2011-12 or those undergraduates who expected to receive a bachelor’s degree during the 2011-12 academic year.

Further details on the representativeness of the college and universities in the NPSAS can be found in Radwin et. al. (2013).

Information on the class of 1999-00 is based on NPSAS:2000. NPSAS:2012 and NPSAS:2000 are based on a sample of about 95,000 and 50,000 undergraduates, respectively.

The estimates were derived using PowerStats, the National Center for Education Statistics’ web-based software to analyze the NPSAS. While PowerStats facilitates the analysis of the NPSAS from the 1996 administration onwards, the 1993 administration of the NPSAS is not presently available in PowerStats. To work around this omission, the report is based on comparable estimates from the base year 1992-93 Baccalaureate and Beyond Longitudinal Study (B&B). NPSAS:93 served as the base year data collection for the 1993 B&B. The base year of the 1993 B&B had approximately 11,200 newly minted baccalaureates.

Finally, a couple of comparability issues require discussion. Total cumulative indebtedness for undergraduate education for the 1992-93 class includes loans from family and friends. For the class of 2000 and 2012 loans from family and friends are not included in cumulative debt (Woo, 2013). Across all three classes cumulative debt for undergraduate education includes both federal loans (but not PLUS loans to parents) and private loans.

NPSAS:2012 did not include students at postsecondary institutions in Puerto Rico, whereas earlier administrations did. In order to make the earlier estimates comparable with the class of 2011-12, graduates of Puerto Rican institutions in earlier classes were filtered out using the COMPTO87 variable.

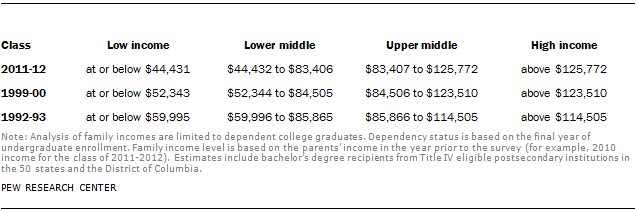

For graduates who were dependent students, the parental income ranges for each quartile were as follows (in 2010 dollars):