How we did this

Pew Research Center conducted this study to understand Americans’ assessments of their personal financial situation during the current period of economic slowdown and high unemployment rates caused by the coronavirus outbreak. For this analysis, we surveyed 13,200 U.S. adults in August 2020. Everyone who took part is a member of Pew Research Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology.

See here to read more about the questions used for this report and the report’s methodology.

Terminology

References to White, Black and Asian adults include only those who are not Hispanic and identify as only one race. Hispanics are of any race.

References to college graduates or people with a college degree comprise those with a bachelor’s degree or more. “Some college” includes those with an associate degree and those who attended college but did not obtain a degree.

“Middle income” is defined here as two-thirds to double the median annual family income for panelists on the American Trends Panel. “Lower income” falls below that range; “upper income” falls above it. See methodology for more details.

It’s been roughly six months since the coronavirus outbreak sent shockwaves through the U.S. economy. While the labor market has recovered somewhat and early stock market losses have been reversed, many Americans continue to face deep financial hardship.

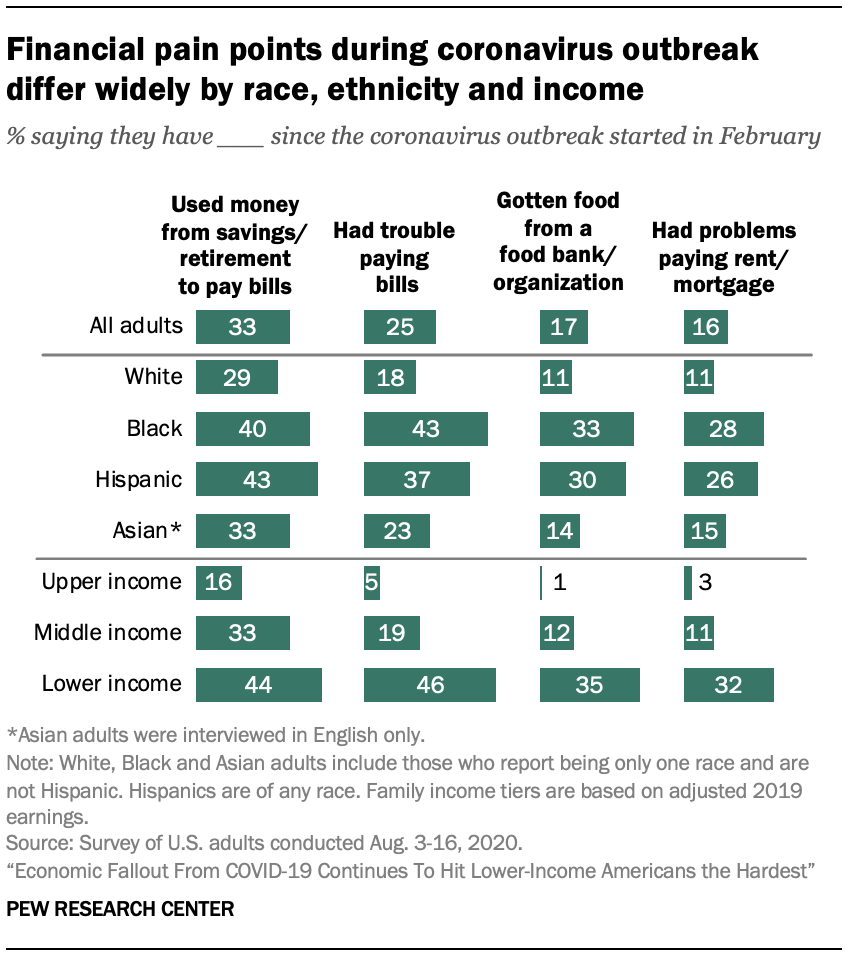

A new Pew Research Center survey finds that, overall, one-in-four adults have had trouble paying their bills since the coronavirus outbreak started, a third have dipped into savings or retirement accounts to make ends meet, and about one-in-six have borrowed money from friends or family or gotten food from a food bank. As was the case earlier this year, these types of experiences continue to be more common among adults with lower incomes, those without a college degree and Black and Hispanic Americans.

Among lower-income adults, 46% say they have had trouble paying their bills since the pandemic started and roughly one third (32%) say it’s been hard for them to make rent or mortgage payments. About one-in-five or fewer middle-income adults have faced these challenges, and the shares are substantially smaller for those in the upper-income tier.1 To be sure, some of these financial pain points may have existed even before the pandemic – particularly for lower-income adults.

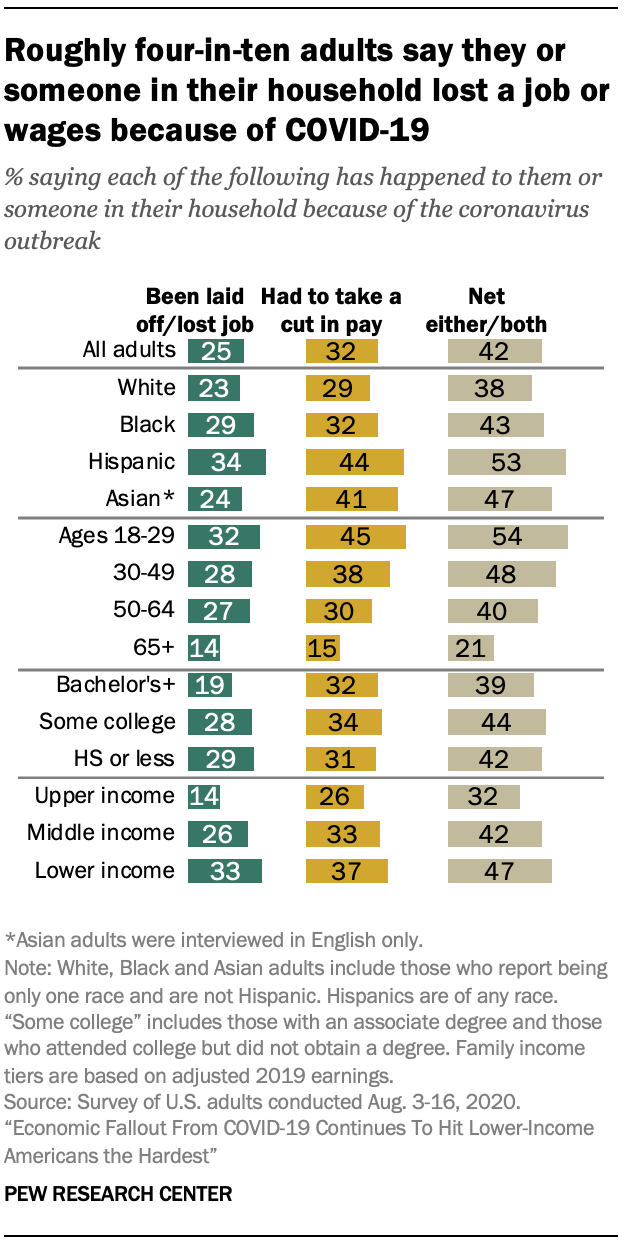

Job loss has also been more acute among certain demographic groups. Overall, 25% of U.S. adults say they or someone in their household was laid off or lost their job because of the coronavirus outbreak, with 15% saying this happened to them personally. Young adults (ages 18 to 29) and lower-income adults are among the most likely to say this has occurred in their household.

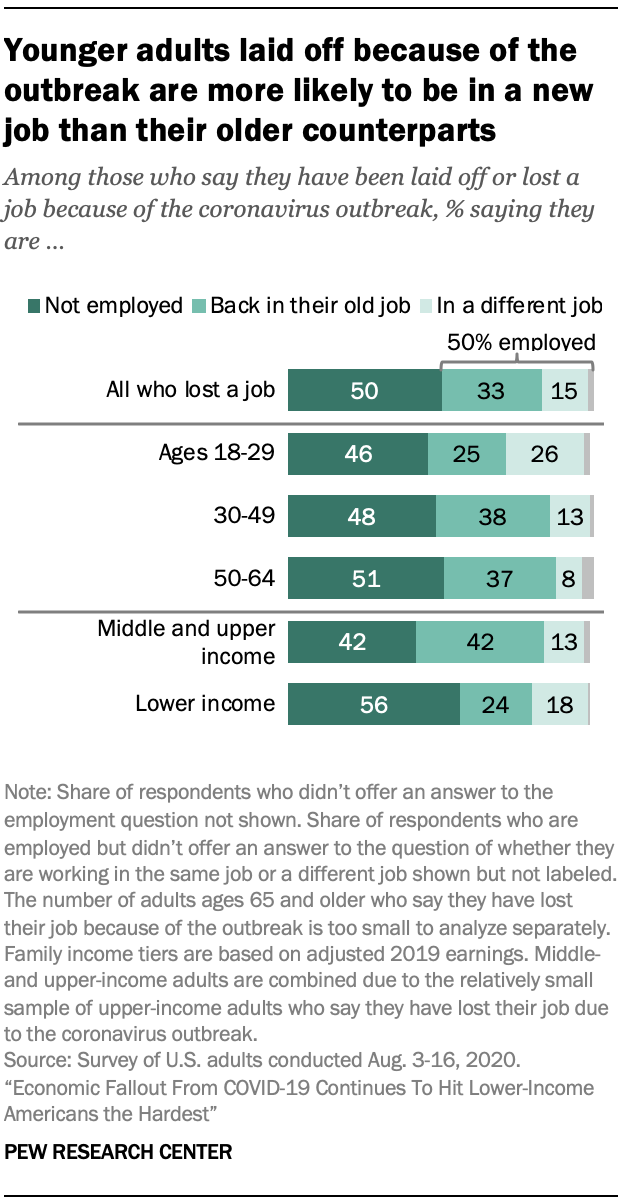

Of those who say they personally lost a job, half say they are still unemployed, a third have returned to their old job and 15% are in a different job than before. Lower-income adults who were laid off due to the coronavirus are less likely to be working now than middle- and upper-income adults who lost their jobs (43% vs. 58%). Adults ages 18 to 29 are less likely than those 30 to 64 to have returned to their previous job.

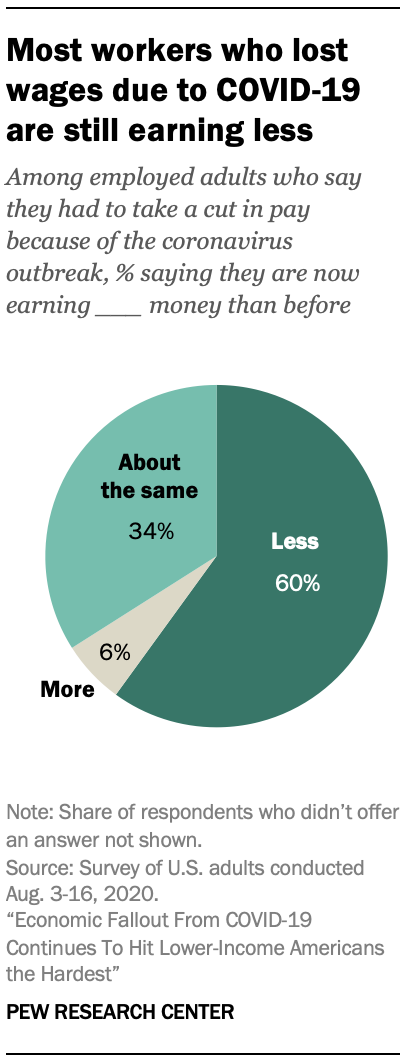

Even if they didn’t lose a job, many workers have had to reduce their hours or take a pay cut due to the economic fallout from the pandemic. About a third of all adults (32%) say this has happened to them or someone in their household, with 21% saying this happened to them personally. Most workers who’ve experienced this (60%) are earning less now than they were before the coronavirus outbreak, while 34% say they are earning the same now as they were before the outbreak and only 6% say they are earning more.

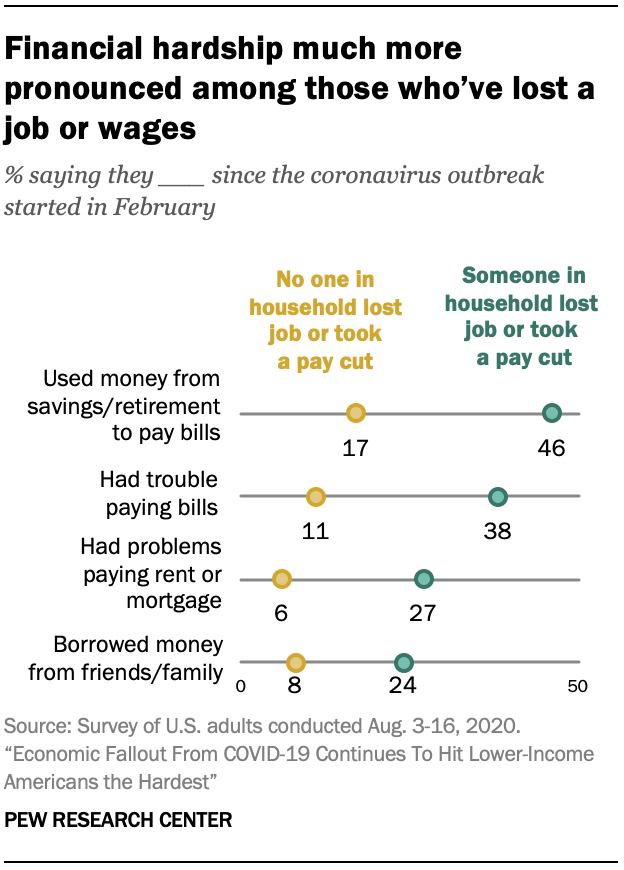

Job disruption, which has been much more pronounced among certain demographic groups, is strongly linked to financial struggles. Americans who have experienced job or wage loss – either personally or in their household – are more than twice as likely as those who have not to say they’ve had trouble paying their bills, struggled to pay their rent or mortgage, used money from savings or retirement to pay bills or borrowed money from friends or family.

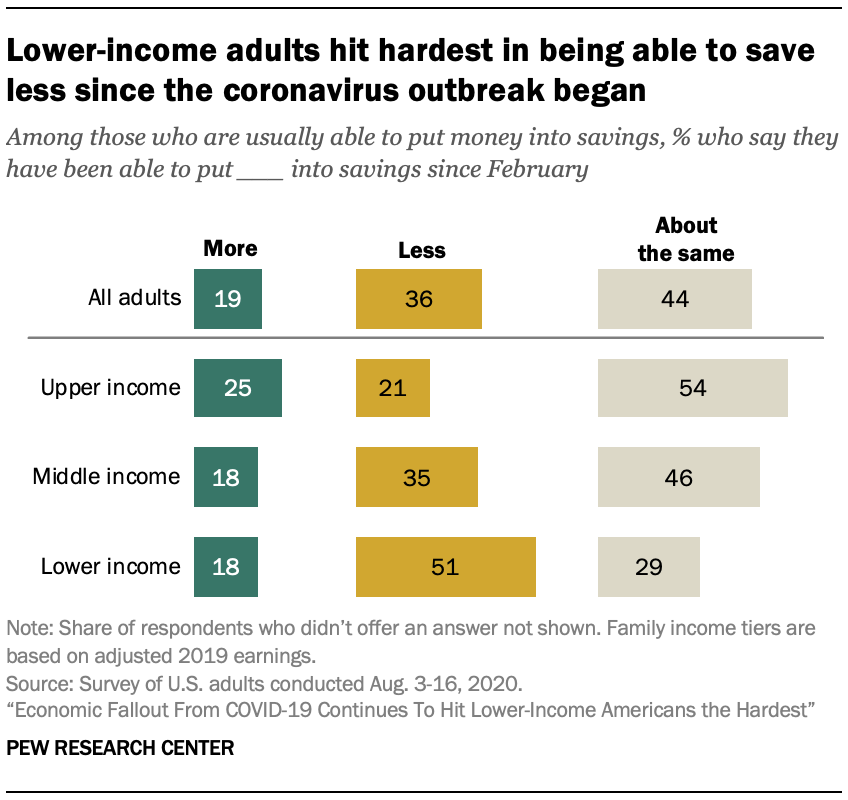

In the meantime, many Americans say their ability to save money has been curtailed by the recent economic upheaval. Among those who indicate they are usually able to put money into savings, 36% say they’ve been saving less since the coronavirus outbreak started. Some 44% say they’ve been saving the same amount as they did before, and 19% say they’ve been saving more. Again, lower-income adults have been hardest hit – 51% among those who can typically save say they have been able to save less in recent months. By comparison, 35% of middle-income adults and 21% of those in the upper-income tier say they’ve been saving less.

These are among the findings of a Pew Research Center survey of 13,200 U.S. adults conducted from Aug. 3-16, 2020, using the Center’s American Trends Panel.2

One-third of adults who said they were laid off because of the coronavirus outbreak are back in their old jobs

A quarter of U.S. adults say they or someone in their household has been laid off or lost a job because of the coronavirus outbreak, and 32% say they or someone else in their household has taken a pay cut due to reduced hours or demand for their work. Overall, 42% say their household has experienced one or both of these. These figures are largely unchanged from when Pew Research Center last asked these questions in early May.

Lower-income adults continue to be the most affected by coronavirus-related job loss or pay cuts. Some 47% of those with lower incomes say they or someone in their household has had these experiences, compared with 42% of those with middle incomes and 32% of upper-income adults.

These experiences also vary by age, with adults younger than 30 more likely than those who are older to say they or someone else in their household has been laid off or taken a pay cut because of the outbreak: 54% of adults ages 18 to 29 say their household has had one or both of these experiences, compared with 48% of those ages 30 to 49, 40% of those 50 to 64 and 21% of adults ages 65 and older.

Among Hispanic Americans, 53% say they or someone else in their household have either been laid off or taken a pay cut because of the coronavirus outbreak, larger than the shares of White (38%) and Black (43%) adults who say the same; 47% of Asian Americans say they or someone else in their household has been laid off or taken a pay cut because of the outbreak.

Half of adults who say they were laid off because of the coronavirus outbreak remain unemployed

Fully 15% of adults report that they personally were laid off or lost their jobs because of the coronavirus outbreak. Of those, one-third say they have returned to the job they had before the outbreak, while 15% are working at a different job. Half say they are currently not employed.

Lower-income adults who lost their job because of the coronavirus outbreak are more likely than those with middle or upper incomes to remain unemployed. Some 56% of workers with lower incomes who lost their job because of the coronavirus outbreak say they are currently unemployed, compared with 42% of middle- and upper-income adults. 3

Among lower-income adults who were laid off because of the outbreak, 24% say they are now back at their old job and 18% are working in a different job. In turn, those with middle and upper incomes who lost their job are far more likely to be back in the same job (42%) than to be in a different job (13%).

Young workers ages 18 to 29 who lost their job because of the coronavirus outbreak are twice as likely as those ages 30 to 49 and about three times as likely as those 50 to 64 to say they are now employed at a different job than before the outbreak (26%, 13% and 8%, respectively).4 On the other hand, adults ages 30 to 64 who say they were laid off because of the coronavirus outbreak are more likely than those ages 18 to 29 to say they have returned to their old job (38% of those ages 30 to 49 and 37% of those ages 50 to 64 vs. 25% of those younger than 30). Similar shares of adults across these three age groups who have been laid off because of the outbreak remain unemployed.

In addition to lost jobs, about one-in-five adults (21%) say that they personally had to take a cut in pay due to reduced hours or demand for their work as a result of the coronavirus outbreak. Most employed adults who say this happened to them (60%) say they are currently making less money than they did before the outbreak; 34% say they are making about the same amount of money and 6% say they are earning more money than before the coronavirus outbreak. There are no significant differences in these measures across demographic groups.

Nearly half of U.S. adults with lower incomes have had trouble paying their bills since the start of the coronavirus pandemic

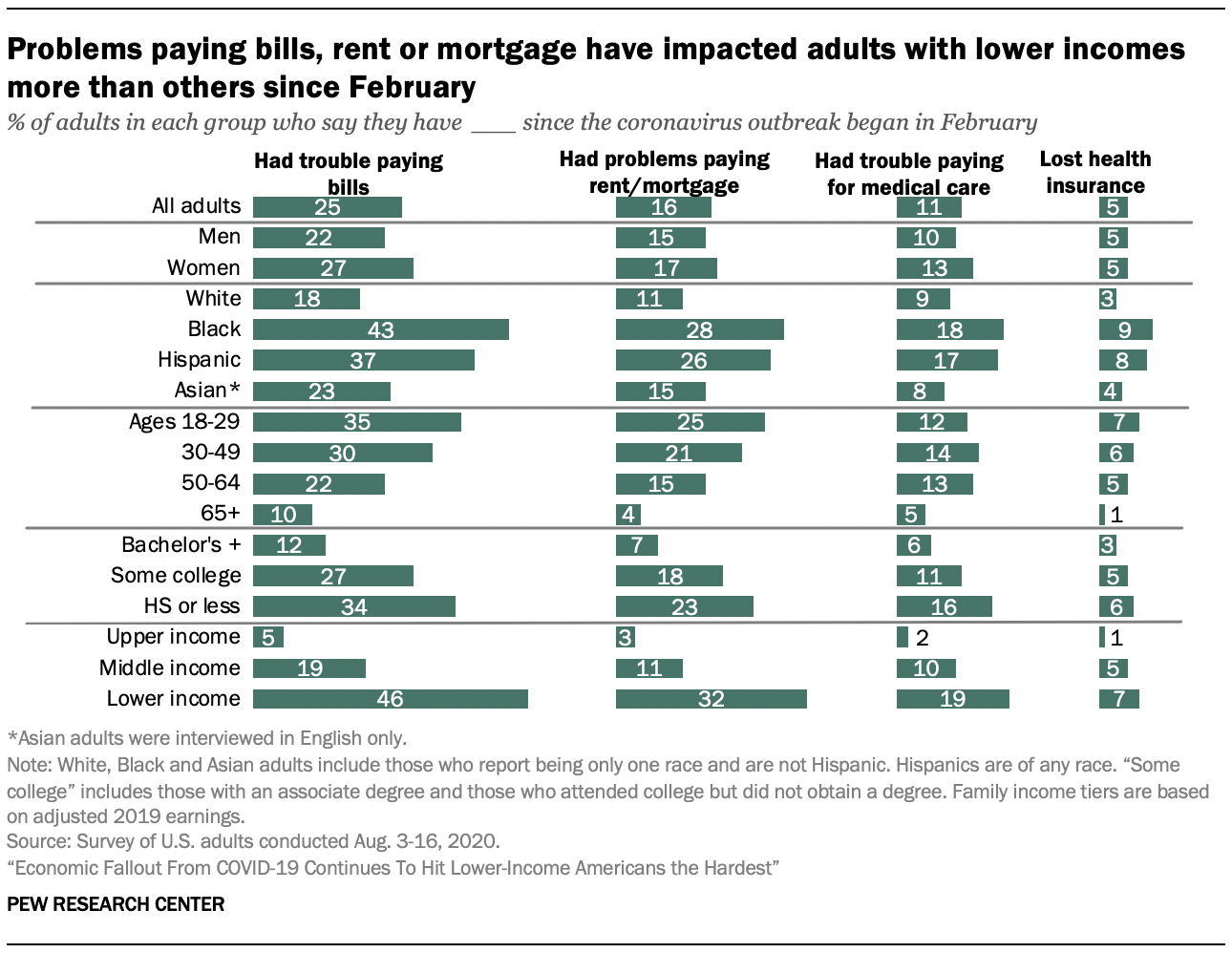

A quarter of U.S. adults say they have had trouble paying their bills since the coronavirus outbreak began. Smaller shares of U.S. adults say they have had problems paying their rent or mortgage (16%) or affording medical care for themselves or their families (11%). Still fewer say they lost their health insurance (5%).

Among adults with lower incomes, 46% say they have had trouble paying their bills, and about a third (32%) have had problems paying their rent or mortgage since February – significantly higher than the share of middle- and upper-income adults who have faced these struggles. This income pattern holds when looking at the shares saying they had trouble paying for medical care or lost their health insurance.

Among other key demographic groups, women, adults under age 30, Black and Hispanic adults, and those who have not obtained a college degree are among the most likely to say they have had trouble paying bills, their rent or mortgage, or for medical care. These groups have been especially impacted by higher unemployment rates during the coronavirus recession.

Black and Hispanic adults are more likely than White and Asian adults to have had trouble paying for medical care, bills or their rent or mortgage. While on most measures Black and Hispanic adults are about equally likely to say they have struggled with these payments, Black adults are more likely to say they have had trouble paying their bills (43%) since the beginning of the coronavirus outbreak than any other racial or ethnic group in the survey.

Age is also associated with people’s ability to pay their bills or rent or mortgage since February. Fully 35% of adults ages 18 to 29 and 30% of those ages 30 to 49 say they have had trouble paying their bills during this time. This compares with 22% of those ages 50 to 64 and 10% of those 65 and older. About one-in-five or more adults ages 18 to 29 (25%) and 30 to 49 (21%) have had trouble paying their rent or mortgage. This is significantly larger than the share among those 50 to 64 (15%) and 65 and older (4%).

Adults without a bachelor’s degree are more likely than those with at least a bachelor’s degree to say they have experienced problems with paying their bills, affording medical expenses for themselves or their families, or making rent or mortgage payments. About a third of adults with a high school diploma or less education (34%) and 27% of those with some college experience say they have struggled with paying bills, compared with 12% of those with a bachelor’s degree or more education. About one-in-five adults with some college or high school or less education say they have had problems paying their rent or mortgage (18% and 23%) since the beginning of the coronavirus outbreak. Those with a high school diploma or less education are twice as likely as those with a bachelor’s degree or more education to have lost their health insurance in the same time period (6% vs. 3%).

People who say they or someone in their household have either been laid off or taken a pay cut as a result of the coronavirus outbreak are more than three times as likely as those who have not faced these hardships to have struggled to pay their bills since the beginning of the outbreak (38% vs. 11%). Similarly, 27% of those who have experienced job loss or a pay cut in their household had problems paying their rent or mortgage, compared with 6% of those who did not experience job or pay loss. People who say they or someone in their household have either been laid off or taken a pay cut as a result of the coronavirus outbreak are also more likely than those who had not to say they have lost their health insurance or had trouble paying for medical care.

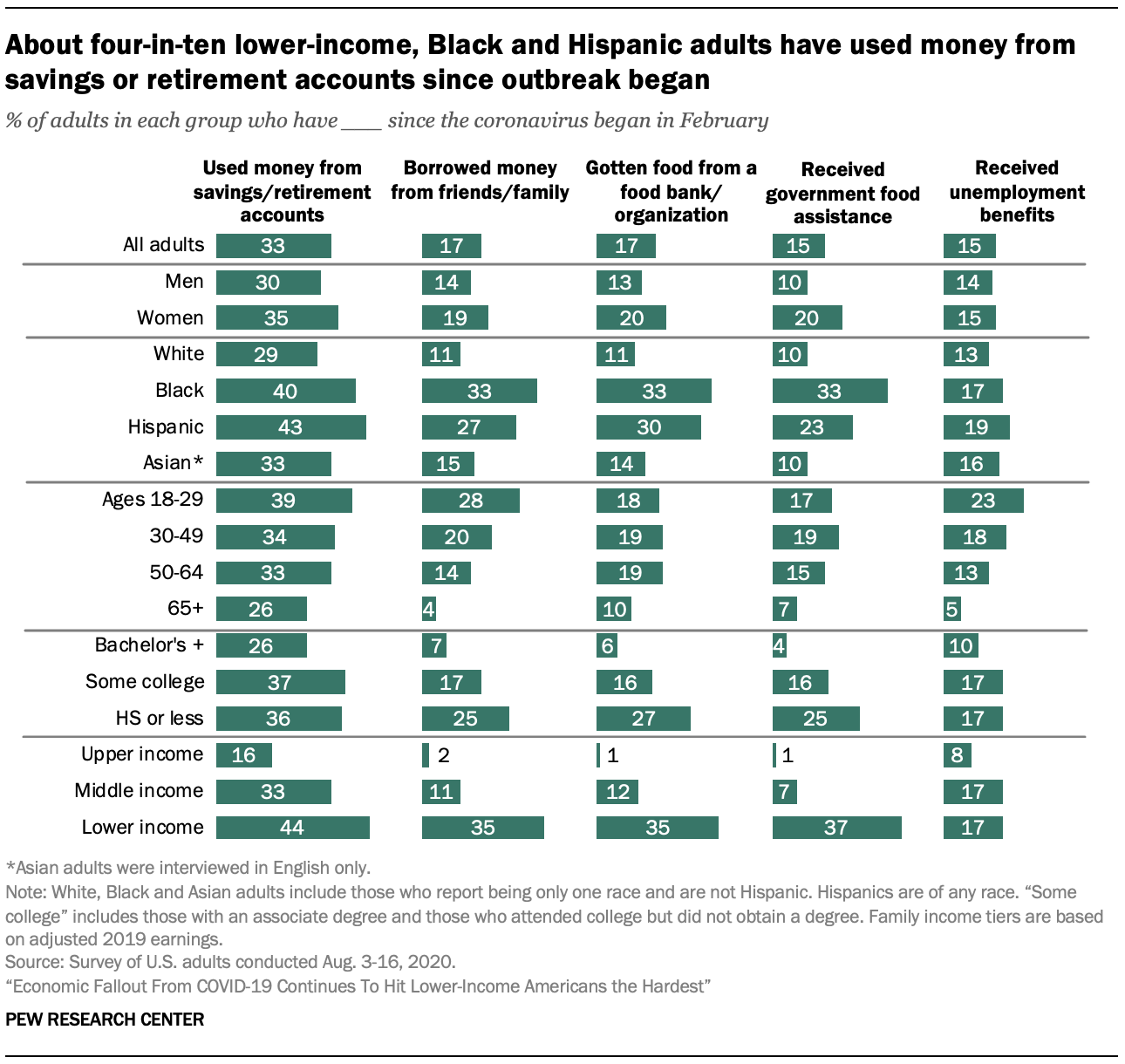

A third of Americans say they have used money from a savings or retirement account to pay their bills since the outbreak

As many Americans struggle with the effects of the coronavirus recession, a third say they have turned to savings or retirement accounts to pay their bills. Additionally, more than one-in-ten have borrowed money from friends or family (17%), gotten food from a food bank or charitable organization (17%), or received government assistance such as Supplemental Nutrition Assistance Program (SNAP) benefits (15%) or unemployment benefits (15%).

Use of these additional resources since the coronavirus outbreak began is more common among Americans with lower incomes. More than four-in-ten lower-income adults (44%) say they have used money from a savings or retirement account to pay their bills during this time, and about a third or more have borrowed money from friends or family (35%), gotten food from a food bank or charitable organization (35%), or received government food assistance (37%). Among middle-income adults, 33% say they have used money from a savings or retirement account to pay their bills, 11% have borrowed money from family or friends, 12% have gotten food from a food bank or charitable organization, and 7% have received government food assistance. While much smaller shares of upper-income adults say they have drawn on these resources, 15% say they used money from a savings or retirement account to pay their bills since the coronavirus began.

Those affected by coronavirus related job loss or pay cuts are much more likely than those who have not experienced these setbacks to have drawn on additional resources. Fully 46% of adults who say they or someone in their household have either been laid off or taken a pay cut as a result of the coronavirus outbreak say they have used money from a savings or retirement account to pay their bills, compared with 17% of those who have not experienced these setbacks. About a quarter of adults who experienced job loss or a pay cut in their household (24%) say they have borrowed money from friends or family; 20% say they have gotten food from a food bank or other charitable organization and 18% say they have received government food assistance.

In addition, these experiences differ significantly by race and ethnicity. About four-in-ten Black (40%) and Hispanic adults (43%) say they have used money from a savings or retirement account to pay their bills since the beginning of the coronavirus outbreak compared with 29% of White adults and 33% of Asian adults. A third of Black adults and about a quarter of Hispanic adults (27%) have borrowed money from family and friends. Smaller shares of White (11%) and Asian (15%) adults have done so.

Black and Hispanic adults are more likely to have drawn on government or charitable food resources since the outbreak began. Black adults (48%) and Hispanic adults (40%) are significantly more likely to say they have drawn on either of these resources since February than White and Asian adults (16% and 19%).

Adults ages 18 to 29 are more likely than those ages 30 and older to have drawn on money from savings or retirement accounts to pay their bills or to have borrowed money from friends or family since the beginning of the coronavirus outbreak. Adults ages 65 and older are less likely than their younger counterparts to have drawn on any of these resources since the outbreak began.

These experiences also differ by educational attainment, with college graduates less likely to have drawn on other funds or governmental or charitable food assistance since the coronavirus outbreak began. Some 36% of those with a high school diploma or less education and 37% of those with some college experience say they have used money from a savings or retirement account to pay their bills, compared with 26% of those with a bachelor’s degree or more education.

About a quarter of adults younger than 30 say they have received unemployment benefits since outbreak began

As the coronavirus pandemic continues and workers are affected by virus-related furloughs and job loss, many Americans are relying on unemployment benefits, including those provided by the CARES Act that expired at the end of July. This study finds that 15% of U.S. adults say they have received unemployment benefits since February.

Upper-income adults are significantly less likely than lower- and middle-income adults to say they have received unemployment benefits (8% vs. 17% each, respectively).

Younger adults are more likely to say they have received unemployment benefits, with the largest share among those younger than 30 (23%). Adults ages 30 to 49 (18%) and 50 to 64 (13%) are still more likely than those ages 65 and older (5%) to have received unemployment benefits (the vast majority of those 65 and older say they were not employed before the coronavirus outbreak).

Americans without a bachelor’s degree (17%) are more likely than those with a bachelor’s degree (10%) to say they have received unemployment benefits.

About half of lower-income adults who can usually put money into savings say they are saving less than before the outbreak

A quarter of U.S. adults say they have been able to put less money than usual into savings since the coronavirus outbreak began; 31% say they have been able to put the same amount as usual into savings, and 13% have been able to put more. About three-in-ten adults (31%) say they are not usually able to put money into savings.

Looking only at those who indicate they can usually put money into savings, 36% say they are able to save less than they did before the coronavirus outbreak, while 19% say they are saving more and 44% say they are saving about the same.

Lower-income adults who are usually able to put money into savings are more likely than those with middle or upper incomes to say they have been able to save less since the coronavirus outbreak began. About half of those with lower incomes (51%) say this, compared with 35% of those with middle incomes and a smaller share (21%) of those with upper incomes. In turn, upper-income adults who can usually put money into savings are more likely than those with middle and lower incomes to say they are now saving more (25% vs. 18% each in the middle- and lower-income groups).

Among women who can usually save, 38% say they are able to put less money in savings than before the coronavirus outbreak, compared with 33% of men who can usually save. The differences are even more striking across racial and ethnic groups: 46% of Black adults and 48% of Hispanic adults who usually save say they are now able to put less into savings, compared with 31% of White and 33% of Asian adults.

There are also differences by age, with young adults more likely than older adults to say they have been able to save less since the beginning of the coronavirus outbreak. Some 47% of adults ages 18 to 29 who usually save say they are able to save less. Among older typical savers, 37% of those ages 30 to 49, 35% of those 50 to 64 and 23% of those ages 65 and older have put less money into savings in the same timeframe. Younger adults are more likely to work in industries impacted by coronavirus shutdowns and to carry more debt, which can affect their ability to save.

Educational differences are also evident among those who usually save. About four-in-ten adults without a bachelor’s degree (41%) say they were able to put less money in savings, compared with 28% of those with a bachelor’s degree or more education.